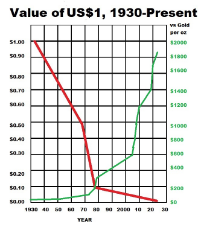

The fed has refused to increase rates

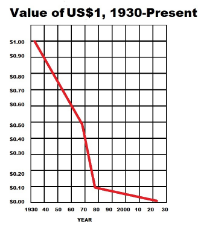

Inflation will continue to grow at an exponential rate

Enjoy the clown show

https://twitter.com/CNBC/status/1486415294469967873

Fed Report:

https://www.federalreserve.gov/newsevents/pressreleases/monetary20220126a.htm

/mlpol/ - My Little Politics

Archived thread

>>332077

Don’t forget they are still considering a March rate hike… and banks and credit agencies could still independently raise their own rates, making the Fed’s rate nothing more than a guideline.

Don’t forget they are still considering a March rate hike… and banks and credit agencies could still independently raise their own rates, making the Fed’s rate nothing more than a guideline.

>>332138

Sure, but inflation is still likely to get a lot worse until then, and probably still after.

The rock bottom interest rates combined with massive government spending, unprecedented printing of dollars, and supply chain disruptions are a recipe for a broken buck.

Sure, but inflation is still likely to get a lot worse until then, and probably still after.

The rock bottom interest rates combined with massive government spending, unprecedented printing of dollars, and supply chain disruptions are a recipe for a broken buck.

>>332139

Again, banks may be pressured to raise their own rates if the Fed takes no action. Also, let us keep in mind that the Fed has tight control over the economy and could take action on its own to combat runaway inflation, though Zimbabwe, Venezuela, and Hungary all seemed to lack control over their own economies at one point.

Again, banks may be pressured to raise their own rates if the Fed takes no action. Also, let us keep in mind that the Fed has tight control over the economy and could take action on its own to combat runaway inflation, though Zimbabwe, Venezuela, and Hungary all seemed to lack control over their own economies at one point.

>>332143

Since when have individual banks ever taken steps to raise rates for the sake of economic stability? They've always been irresponsible, grifting assholes. That was most of the justification for making the fed in the first place (albeit a shitty one).

Since when have individual banks ever taken steps to raise rates for the sake of economic stability? They've always been irresponsible, grifting assholes. That was most of the justification for making the fed in the first place (albeit a shitty one).

>>332144

They could be pressured by investors from other industries to raise their own rates to combat inflation. I sincerely doubt hyperinflation would be in the US’s future, especially if the T-bill rate is used as the risk-free rate around the world and the US dollar is among the most widely traded currencies that exist, but if worse came to worst and the government were taking no action, it would be up to the stakeholders to pressure the banks to act.

They could be pressured by investors from other industries to raise their own rates to combat inflation. I sincerely doubt hyperinflation would be in the US’s future, especially if the T-bill rate is used as the risk-free rate around the world and the US dollar is among the most widely traded currencies that exist, but if worse came to worst and the government were taking no action, it would be up to the stakeholders to pressure the banks to act.

>>332138

Better than fair odds of this, they'll want to incentivize bond purchases leading into tax-return season

Better than fair odds of this, they'll want to incentivize bond purchases leading into tax-return season

>>332145

I highly doubt individual banks are going to do anything. Even if a few did, they're not united in their agendas, and economy stability is not their priority. Shareholders only want their stocks to go up.

I highly doubt individual banks are going to do anything. Even if a few did, they're not united in their agendas, and economy stability is not their priority. Shareholders only want their stocks to go up.

>>332150

Yeah, obviously, but in case you don't remember the housing crisis we had 14 years ago, individual banks aren't really known for their economic responsibility, even in the face of self-destructive economic collapse.

Yeah, obviously, but in case you don't remember the housing crisis we had 14 years ago, individual banks aren't really known for their economic responsibility, even in the face of self-destructive economic collapse.

>>332156

In that case, there were financial fraud and some circumstances investors and banks had little control over. In the case of hyperinflation, investors could threaten to pull their money from banks if they don’t raise their rates.

In that case, there were financial fraud and some circumstances investors and banks had little control over. In the case of hyperinflation, investors could threaten to pull their money from banks if they don’t raise their rates.

>>332157

Well, that's an optimistic look at the banking industry.

I, personally, don't have nearly as much trust in bankers, or the fed itself for that matter.

Well, that's an optimistic look at the banking industry.

I, personally, don't have nearly as much trust in bankers, or the fed itself for that matter.

1643311473.mp4 (2.0 MB, Resolution:520x388 Length:00:00:21, 47eca6095244dfb56fac801132570f6bfe1b1cf992aa0b4be9993dc302ce48cb.mp4) [play once] [loop]

>>332157

>and some circumstances investors and banks had little control over

Do you actually believe this?

>and some circumstances investors and banks had little control over

Do you actually believe this?

>>332157

>investors and banks had little control over.

This is bullshit. The banks knew very well what they were doing when they gave out predatory, high-interest loans to people they knew damn well couldn't afford them. They were hoping to acquire as many houses as possible for resale value, and they gambled the entire economy to do so.

>investors and banks had little control over.

This is bullshit. The banks knew very well what they were doing when they gave out predatory, high-interest loans to people they knew damn well couldn't afford them. They were hoping to acquire as many houses as possible for resale value, and they gambled the entire economy to do so.

>>332184

>The banks knew very well what they were doing when they gave out predatory, high-interest loans to people they knew damn well couldn't afford them.

What else are you suppose to do when the government passes laws requiring your company to be non-discriminatory against all clients who ask for loans?

>The banks knew very well what they were doing when they gave out predatory, high-interest loans to people they knew damn well couldn't afford them.

What else are you suppose to do when the government passes laws requiring your company to be non-discriminatory against all clients who ask for loans?

>>332185

They could have come up with other reasons, substantial ones. It's not like they were only doing it to niggers either.

They could have come up with other reasons, substantial ones. It's not like they were only doing it to niggers either.

>>332185

Also

Redlining had already been illegal for 40 years before the housing crisis. As much as it would feel fun to blame niggers for the collapse, the real irresponsibility was the irresponsible and predatory behavior of bankers. They ruined countless white families and fragmented communities all over the country with their bullshit, and their financial monopolies got them bailed out at taxpayer's expense.

Also

Redlining had already been illegal for 40 years before the housing crisis. As much as it would feel fun to blame niggers for the collapse, the real irresponsibility was the irresponsible and predatory behavior of bankers. They ruined countless white families and fragmented communities all over the country with their bullshit, and their financial monopolies got them bailed out at taxpayer's expense.

>>332187

> the real irresponsibility was the irresponsible and predatory behavior of bankers.

How? How are the bankers responsible for the average person being an idiot and taking out loans to pay items they did not need?

> the real irresponsibility was the irresponsible and predatory behavior of bankers.

How? How are the bankers responsible for the average person being an idiot and taking out loans to pay items they did not need?

>>332188

>What's wrong with loan sharks?

They are responsible because they have the means to refuse loans to people who can't pay them. If you give predatory loans to people who can't afford them on a mass scale, you risk tanking the entire economy.

>imying everyone else was stupid except for the bankers who made the majority of transactions, held most of the power, and stood to profit the most from irresponsible practices

Tens of thousands of people were ruined by the housing crisis, bankers were only a fraction of one percent of them. When a tiny number of people cause shit that tanks the economy, it's obvious who's to blame.

>What's wrong with loan sharks?

They are responsible because they have the means to refuse loans to people who can't pay them. If you give predatory loans to people who can't afford them on a mass scale, you risk tanking the entire economy.

>imying everyone else was stupid except for the bankers who made the majority of transactions, held most of the power, and stood to profit the most from irresponsible practices

Tens of thousands of people were ruined by the housing crisis, bankers were only a fraction of one percent of them. When a tiny number of people cause shit that tanks the economy, it's obvious who's to blame.

>>332189

>They are responsible because they have the means to refuse loans to people who can't pay them.

You just said that redlining is illegal, so how is it possible for them to reject loans?

> Tens of thousands of people were ruined by the housing crisis

And? People were ruined during the crash of 1908, the Great Depression, both world wars, the economic crash back in the 50's, the economic back in the 70's. What makes this so special?

> When a tiny number of people cause shit that tanks the economy

How is it a "tiny" number of people? You first have the banks who were originally rejecting loans to "bad clients", then those bad clients plead to the government to change the laws, so now banks are require to issue loans to those bad clients, and those bad clients take put so many loans that they tank the economy.

It sounds like you have a series of individuals responsible, who range from the average person to the bankers to the politicians.

>They are responsible because they have the means to refuse loans to people who can't pay them.

You just said that redlining is illegal, so how is it possible for them to reject loans?

> Tens of thousands of people were ruined by the housing crisis

And? People were ruined during the crash of 1908, the Great Depression, both world wars, the economic crash back in the 50's, the economic back in the 70's. What makes this so special?

> When a tiny number of people cause shit that tanks the economy

How is it a "tiny" number of people? You first have the banks who were originally rejecting loans to "bad clients", then those bad clients plead to the government to change the laws, so now banks are require to issue loans to those bad clients, and those bad clients take put so many loans that they tank the economy.

It sounds like you have a series of individuals responsible, who range from the average person to the bankers to the politicians.

>>332189

>>332190

>And? People were ruined during the crash of 1908, the Great Depression, both world wars, the economic crash back in the 50's, the economic back in the 70's. What makes this so special?

I should specify that the point I was making is that crashes happen ALL THE TIME, so how is it specifically the banks fault that you didn't prepare for when a crash does occur?

>>332190

>And? People were ruined during the crash of 1908, the Great Depression, both world wars, the economic crash back in the 50's, the economic back in the 70's. What makes this so special?

I should specify that the point I was making is that crashes happen ALL THE TIME, so how is it specifically the banks fault that you didn't prepare for when a crash does occur?

>>332190

You can still reject loans on the basis of bad credit.

>What makes this so special?

That wasn't the point. The point was the proportion of people who were impacted vs the proportion of people who held the cards. Humanity didn't suddenly get stupider; it was practice by people who were making the most decisions. Stupidity on behalf of bankers, not the populous.

>Laws

The laws do not necessitate predatory lending. That's just deflection. They were intentionally being risky. You can only blame the government for so much.

What I really blame the government for is bailing out the banks at the cost of the average citizen when they should have jailed bankers and bailed out individual families.

>series of individuals responsible

Holy shit, this is Weimar-tier semitism. "It's the average citizen that caused the crisis." Absolutely ridiculous. How can you not see that a small number of people held the majority of the power in this fiasco?

You can still reject loans on the basis of bad credit.

>What makes this so special?

That wasn't the point. The point was the proportion of people who were impacted vs the proportion of people who held the cards. Humanity didn't suddenly get stupider; it was practice by people who were making the most decisions. Stupidity on behalf of bankers, not the populous.

>Laws

The laws do not necessitate predatory lending. That's just deflection. They were intentionally being risky. You can only blame the government for so much.

What I really blame the government for is bailing out the banks at the cost of the average citizen when they should have jailed bankers and bailed out individual families.

>series of individuals responsible

Holy shit, this is Weimar-tier semitism. "It's the average citizen that caused the crisis." Absolutely ridiculous. How can you not see that a small number of people held the majority of the power in this fiasco?

1643329002.png (143.2 KB, 1013x788, 157a5e298ff2078d71af9754abc10e04.png)

>>332077

>bad news

inflation keeps getting worse

>good news

speculative asset bubble also continues, so I can keep making money in junk stocks and crypto

>bad news

civilization collapse inevitable at this point

>good news

civilization collapse inevitable at this point

seriously, I don't even know how to react to stuff like this anymore. I feel nothing.

>bad news

inflation keeps getting worse

>good news

speculative asset bubble also continues, so I can keep making money in junk stocks and crypto

>bad news

civilization collapse inevitable at this point

>good news

civilization collapse inevitable at this point

seriously, I don't even know how to react to stuff like this anymore. I feel nothing.

>>332200

>You can still reject loans on the basis of bad credit.

So, that's why they emphasize credit scores so bad.

> The point was the proportion of people who were impacted vs the proportion of people who held the cards.

You're surprised that people who cannot budget worth a damn are impacted by even the slightest glitch that happens in the market, meanwhile those with their finances in order can still keep trucking along?

> Holy shit, this is Weimar-tier semitism. "It's the average citizen that caused the crisis."

The situation in Weimar was completely different. First of all, the nation is the size of your average American state, so they're more easily impacted than other nations. Second, Weimar was the result of a bunch of retards thinking that a democracy is the one-all-end-all government, which it is not, and pushed it onto a populace who didn't want it, nor were prepared for it, with a constitution that did absolutely nothing to maintain it's democratic structure. Third, Weimar was require to repay reparations for a war they didn't start. How does that compare at all to the 2008 market crash?

> How can you not see that a small number of people held the majority of the power in this fiasco?

Because I'm looking at all the people who PUT that "small number" in power.

>You can still reject loans on the basis of bad credit.

So, that's why they emphasize credit scores so bad.

> The point was the proportion of people who were impacted vs the proportion of people who held the cards.

You're surprised that people who cannot budget worth a damn are impacted by even the slightest glitch that happens in the market, meanwhile those with their finances in order can still keep trucking along?

> Holy shit, this is Weimar-tier semitism. "It's the average citizen that caused the crisis."

The situation in Weimar was completely different. First of all, the nation is the size of your average American state, so they're more easily impacted than other nations. Second, Weimar was the result of a bunch of retards thinking that a democracy is the one-all-end-all government, which it is not, and pushed it onto a populace who didn't want it, nor were prepared for it, with a constitution that did absolutely nothing to maintain it's democratic structure. Third, Weimar was require to repay reparations for a war they didn't start. How does that compare at all to the 2008 market crash?

> How can you not see that a small number of people held the majority of the power in this fiasco?

Because I'm looking at all the people who PUT that "small number" in power.

1643329776.mp4 (2.7 MB, Resolution:262x480 Length:00:00:46, Inflation in Venezuela is so high that people are throwing away wads of cash.mp4) [play once] [loop]

>Inflation in Venezuela is so high that people are throwing away wads of cash

Coming to your country soon.

Coming to your country soon.

>>332204

>those with their finances in order can still keep trucking along?

They did not "keep trucking along". Taxpayers bailed them out. The government subsidized the incompetence of irresponsible bankers.

>those with their finances in order can still keep trucking along?

They did not "keep trucking along". Taxpayers bailed them out. The government subsidized the incompetence of irresponsible bankers.

>>332206

> They did not "keep trucking along".

Yeah, looking it up, over 450 banks closed their doors: https://infogalactic.com/info/List_of_bank_failures_in_the_United_States_(2008–present)

> The government subsidized the incompetence of irresponsible bankers.

No, they didn't. The government illegally bought, restructured, and operated the company's they "bailed out": https://archive.ph/kjlwV

In other words, it's still the same company on the label, however none of the original crew (Everyone present up the 2008 market crash) is still present.

> They did not "keep trucking along".

Yeah, looking it up, over 450 banks closed their doors: https://infogalactic.com/info/List_of_bank_failures_in_the_United_States_(2008–present)

> The government subsidized the incompetence of irresponsible bankers.

No, they didn't. The government illegally bought, restructured, and operated the company's they "bailed out": https://archive.ph/kjlwV

In other words, it's still the same company on the label, however none of the original crew (Everyone present up the 2008 market crash) is still present.

>>332209

>The government illegally bought, restructured, and operated the company's they "bailed out"

And then they sold them back for tiny fractions of what they were worth.

>The government illegally bought, restructured, and operated the company's they "bailed out"

And then they sold them back for tiny fractions of what they were worth.

>>332211

>sold them back for tiny fractions of what they were worth

That didn't happen either. Directly in the archive I linked, the government actually increased the value of the company, which is the only reason the government managed to escape a lawsuit concerning their takeover of AIG and other companies.

>sold them back for tiny fractions of what they were worth

That didn't happen either. Directly in the archive I linked, the government actually increased the value of the company, which is the only reason the government managed to escape a lawsuit concerning their takeover of AIG and other companies.

>>332213

>I know what appened.

Apparently, you don't. You DON'T know that hundreds of banks closed their doors forever, you DON'T know that the government performed a hostile takeover on the banks that survived, you DON'T know that the people that caused the crash were all either fired or ousted in another manner, and you DON'T know that the banks actually ended up in a better financial situation afterwards.

It's not a bad thing to "not know" (Hey, I didn't know about how they use credit scores instead of redlining), but it does show that there has been a specific crafted narrative about the entire event that people want to keep going.

>I know what appened.

Apparently, you don't. You DON'T know that hundreds of banks closed their doors forever, you DON'T know that the government performed a hostile takeover on the banks that survived, you DON'T know that the people that caused the crash were all either fired or ousted in another manner, and you DON'T know that the banks actually ended up in a better financial situation afterwards.

It's not a bad thing to "not know" (Hey, I didn't know about how they use credit scores instead of redlining), but it does show that there has been a specific crafted narrative about the entire event that people want to keep going.

>>332215

> DON'T know that the government performed a hostile takeover on the banks that survived, you DON'T know that the people that caused the crash were all either fired or ousted in another manner,

the fact that the government did the former means that the latter definitely didn't happen since it's the government and elites that absolutely caused it to seize any rogue banking operation.

> DON'T know that the government performed a hostile takeover on the banks that survived, you DON'T know that the people that caused the crash were all either fired or ousted in another manner,

the fact that the government did the former means that the latter definitely didn't happen since it's the government and elites that absolutely caused it to seize any rogue banking operation.

>>332234

Furthermore, it was a financial assault on white suburbs with the result of fragmenting neighborhoods and hoovering multigenerational white communities. This actually hurt white people even more than it did niggers.

Furthermore, it was a financial assault on white suburbs with the result of fragmenting neighborhoods and hoovering multigenerational white communities. This actually hurt white people even more than it did niggers.

>The Fed Has Triggered A Stagflationary Disaster That Will Hit Hard This Year

https://alt-market.us/the-fed-has-triggered-a-stagflationary-disaster-that-will-hit-hard-this-year/

https://alt-market.us/the-fed-has-triggered-a-stagflationary-disaster-that-will-hit-hard-this-year/

>>332253

they created the situation SO THAT they could commit financial fraud

the fact that other people could also commit fraud at the same time as they did is just as irrelevant as saying the nigger who broke into a walmart to steal the cash safe and all valuables isn't at fault for the damage caused by the looters and theives waiting patiently right behind him. this innocent man was just having a jog in a closed store at midnight when suddenly hundreds of niggers poured in and stole everything around him! honest goy!

they created the situation SO THAT they could commit financial fraud

the fact that other people could also commit fraud at the same time as they did is just as irrelevant as saying the nigger who broke into a walmart to steal the cash safe and all valuables isn't at fault for the damage caused by the looters and theives waiting patiently right behind him. this innocent man was just having a jog in a closed store at midnight when suddenly hundreds of niggers poured in and stole everything around him! honest goy!

1643480760.png (49.1 KB, 928x352, Screenshot_2022-01-29_10-23-36.png)

>>332253

>cousin 1 shows cousin 2 and 5 a new scheme involving fraud

>cousin 2 and 5 do the minor fraud

>cousin 3 and his other cousins help cousins 2 and 5 with the fraud by doing some more minor fraud

>cousin 4 wants a slice, so he helps pump the scheme

>cousin 1 helps cover for cousin 2 and 5

>"I FUCKING LOVE NUMBERS" distracts public from critical thinking

>cousin 12, who operates a government funded, family owned and operated counter-intelligence business deflects public attention from the critical thinkers using mystical words and phrases developed by cousins 6 generations ago.

>the family pulls out of the scheme as it reaches critical mass

>cousin 4 publishes articles and televised segments detailing how nobody could have seen this happening

>cousin 1 convinces the public to pay him for "falling victim to the scheme"

>cousin 4 pumps the sad sap story to seal the deal on victim payouts to the family

>cousins 18-99 write detailed books on the structure of the scheme, produce and direct films about the major players, and serve as judges for the trials of cousins 1, 2, and 5.

>cousin 101 becomes the new cousin 1

You are extremely naive.

>cousin 1 shows cousin 2 and 5 a new scheme involving fraud

>cousin 2 and 5 do the minor fraud

>cousin 3 and his other cousins help cousins 2 and 5 with the fraud by doing some more minor fraud

>cousin 4 wants a slice, so he helps pump the scheme

>cousin 1 helps cover for cousin 2 and 5

>"I FUCKING LOVE NUMBERS" distracts public from critical thinking

>cousin 12, who operates a government funded, family owned and operated counter-intelligence business deflects public attention from the critical thinkers using mystical words and phrases developed by cousins 6 generations ago.

>the family pulls out of the scheme as it reaches critical mass

>cousin 4 publishes articles and televised segments detailing how nobody could have seen this happening

>cousin 1 convinces the public to pay him for "falling victim to the scheme"

>cousin 4 pumps the sad sap story to seal the deal on victim payouts to the family

>cousins 18-99 write detailed books on the structure of the scheme, produce and direct films about the major players, and serve as judges for the trials of cousins 1, 2, and 5.

>cousin 101 becomes the new cousin 1

You are extremely naive.

46 replies | 19 files | 13 UUIDs | Archived

Ex: Type :littlepip: to add Littlepip

Ex: Type :littlepip: to add Littlepip  Ex: Type :eqg-rarity: to add EqG Rarity

Ex: Type :eqg-rarity: to add EqG Rarity