Since we're in the middle of a Crypto Bull Market yet again and I trust you fuckers more than the average /biz/raeli I think we should have a crypto thread.

Here are some useful links I've picked up on over the years.

https://www.lookintobitcoin.com/charts/rhodl-ratio/

https://alternative.me/crypto/fear-and-greed-index/

Some lads at 4chins also have made a market analysis tool.

Although it only works on ERC tokens as I've so far seen.

https://kek.tools/t/0x3fa400483487a489ec9b1db29c4129063eec4654

So what are you fellas holding? Do you have any crypto?

I've got some linkies that have been treating me well and I scooped up some REEF from UNISWAP as of late. Seems the next BIG project will likely be an ETH killer due to all the GAS FEEs making the network neigh unusable as of late. Staking and lending pools seem to be all the rage as well this run.

So any gems you lads know of you'd be willing to shill to a fellow horsefucker?

/mlpol/ - My Little Politics

Archived thread

>>301028

What Cryptos have their wealth backed by something?

If they can't be inflated by jews that's a plus but are any guaranteed to mean something no matter how people view them in ten years?

What Cryptos have their wealth backed by something?

If they can't be inflated by jews that's a plus but are any guaranteed to mean something no matter how people view them in ten years?

>>301028

>So any gems you lads know of you'd be willing to shill to a fellow horsefucker?

Doge is a meme, and bully anyone who suggests it. I heard that Litecoin is worth considering. However, overall, here's a good summary on the cryptocurrencies worth considering:

Bitcoin

>Bitcoin was the first, but it's got serious technical problems that can't be fixed. At the same time, it's "too big to fail", if faith in bitcoin falls, all the rest of the cryptos will too, regardless of technical improvements.

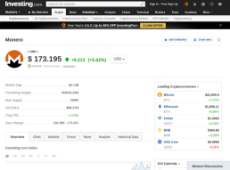

Monero

>One of the technical problems with bitcoin is that bitcoins are not fungible, that is, a bitcoin can be tracked. You could, for example, have a list of "stolen/illegitamite" bitcoins, and force honest merchants not to accept these bitcoins. Monero fixes this problem by making it impossible to track which coins are sent to whom in a block, this makes it impossible to maintain any sort of list, all Monero is created equal. Technically, you could do the same kind of thing with the bank note number of USD, but of course nobody does 'cuz that would be real inconvenient. Some people suggest that with cryptocurrencies it would be more convenient and so we make our crypto fungible.

Dash

>Another of the technical problems with bitcoin is that it was structured so that a new block is mined about every 10 minutes, this means, on average, it'll take 10 minutes for a transaction to "go through". But wait, there's more! You don't just want to see your transaction go though, you want to wait for 2 or 3 blocks to be built on top of it so you're fairly confident no one else is working on a different but still legitimate version of the block chain. Imagine going to the grocery and trying to pay with Bitcoin, it will take you 30 to 40 minutes to check out. I'll also nitpick this Anon's post, the "fee" associated with crypto transactions dosen't go to a bank, it's a bounty you put out to encourage miners to put your transaction in the next block. Dash "fixes" this problem by making the time to mine a new block about 15 seconds. There's really no technical achievement here, it's just a faster, less popular bitcoin.

Etherium

>"Bro, what if we putprograms "Smart contracts" on the blockchain, and then paid other people to run the programs with crypto, attached to the program?". Kinda a neat idea, but until someone really finds a good use for it, it's a novelty. I'll also mention that Etherium is supposed to be switching to a Proof of Stake system, we'll see how popular the fork is though.

Proof of Stake

>A way to build a blockchain, not a cryptocurrency onto itself. instead of guessing numbers to build the next block and get rewarded with the fees + a set amount of the coin, a miner validator is chosen randomly(ish) to create the next block, there are no fees involved and instead the validator and everyone who checks their work receives a flat commission for creating the bock or attesting to it's correctness.. Being offline when you're asked to create a block or disagreeing with other people validating the correctness of a block looses you crypto.

>My personal favorite at the moment is Stellar

>Cryptocurrency tied to other assets, these could be other cryptocurrencies like Bitcoin, non-crypto currencies like USD or Pesos, physical commodities like Gold or Silver, or any other asset. It's totally not a cryptocurrency though, it breaks the "trustless" rule that all other cryptos have, instead you trust a set of asset brokers that you can buy or sell derivatives from, think of it more as a decentralized group of stock brokers than a cryptocurrency.

>So any gems you lads know of you'd be willing to shill to a fellow horsefucker?

Doge is a meme, and bully anyone who suggests it. I heard that Litecoin is worth considering. However, overall, here's a good summary on the cryptocurrencies worth considering:

Bitcoin

>Bitcoin was the first, but it's got serious technical problems that can't be fixed. At the same time, it's "too big to fail", if faith in bitcoin falls, all the rest of the cryptos will too, regardless of technical improvements.

Monero

>One of the technical problems with bitcoin is that bitcoins are not fungible, that is, a bitcoin can be tracked. You could, for example, have a list of "stolen/illegitamite" bitcoins, and force honest merchants not to accept these bitcoins. Monero fixes this problem by making it impossible to track which coins are sent to whom in a block, this makes it impossible to maintain any sort of list, all Monero is created equal. Technically, you could do the same kind of thing with the bank note number of USD, but of course nobody does 'cuz that would be real inconvenient. Some people suggest that with cryptocurrencies it would be more convenient and so we make our crypto fungible.

Dash

>Another of the technical problems with bitcoin is that it was structured so that a new block is mined about every 10 minutes, this means, on average, it'll take 10 minutes for a transaction to "go through". But wait, there's more! You don't just want to see your transaction go though, you want to wait for 2 or 3 blocks to be built on top of it so you're fairly confident no one else is working on a different but still legitimate version of the block chain. Imagine going to the grocery and trying to pay with Bitcoin, it will take you 30 to 40 minutes to check out. I'll also nitpick this Anon's post, the "fee" associated with crypto transactions dosen't go to a bank, it's a bounty you put out to encourage miners to put your transaction in the next block. Dash "fixes" this problem by making the time to mine a new block about 15 seconds. There's really no technical achievement here, it's just a faster, less popular bitcoin.

Etherium

>"Bro, what if we put

Proof of Stake

>A way to build a blockchain, not a cryptocurrency onto itself. instead of guessing numbers to build the next block and get rewarded with the fees + a set amount of the coin, a miner validator is chosen randomly(ish) to create the next block, there are no fees involved and instead the validator and everyone who checks their work receives a flat commission for creating the bock or attesting to it's correctness.. Being offline when you're asked to create a block or disagreeing with other people validating the correctness of a block looses you crypto.

>My personal favorite at the moment is Stellar

>Cryptocurrency tied to other assets, these could be other cryptocurrencies like Bitcoin, non-crypto currencies like USD or Pesos, physical commodities like Gold or Silver, or any other asset. It's totally not a cryptocurrency though, it breaks the "trustless" rule that all other cryptos have, instead you trust a set of asset brokers that you can buy or sell derivatives from, think of it more as a decentralized group of stock brokers than a cryptocurrency.

Would anons consider khan academy be a good resource as a crash course in finance and day trading? Would the knowledge translate well enough to crypto? What kind of knowledge does one need to know what they're doing generally?

>>301035

>Stellar

How is this related to Ripple and XRP? I see that name come up lurking in /xsg/ occasionally.

>>301035

>Stellar

How is this related to Ripple and XRP? I see that name come up lurking in /xsg/ occasionally.

What's the best way for a bongistanian to pick up some bitcoin? Only looking to invest a hundred or so pound. Would rather not give my passport to random crypto sellers.

>>301074

/xsg/ recommends xumm or trustwallet for hot storage. Not certain if those would meet said specifications.

/xsg/ recommends xumm or trustwallet for hot storage. Not certain if those would meet said specifications.

1613090889.gif (8.7 MB, 657x487, EMPIRE-OF-DUST-ITS-ALL-SO-TIRESOME.gif)

>>301028

Sorry to pour gelid water in this thread OP, but this has to be the bread number 50 surveying the horsefuckers.

It begun with the assumption of virgin incels in the mom's basement, later the commies correct themselves and approach with the tech-nerd hacking stuff, now it is about to measure how wealthy we are.

Please be a bit more original next time.

Sorry to pour gelid water in this thread OP, but this has to be the bread number 50 surveying the horsefuckers.

It begun with the assumption of virgin incels in the mom's basement, later the commies correct themselves and approach with the tech-nerd hacking stuff, now it is about to measure how wealthy we are.

Please be a bit more original next time.

1613097823.jpg (251.5 KB, 1920x1080, 89cbc2a80bc12f2b3265c69242af5c62.jpg)

>>301096

Don't want to be that guy, but two of those threads have one reply and on average they were made two years ago. Not really certain if "just ask /cyb/" is gonna cut it for now. That and there's a few threads active on /mlpol/ that could easily be placed in /ub/ as well, so that's why I didn't more than blink when this one was created.

I've been meaning to make a QTDDTOT thread on /cyb/ lately though. Hopefully I'll get around to it and it becomes a bit more active.

Don't want to be that guy, but two of those threads have one reply and on average they were made two years ago. Not really certain if "just ask /cyb/" is gonna cut it for now. That and there's a few threads active on /mlpol/ that could easily be placed in /ub/ as well, so that's why I didn't more than blink when this one was created.

I've been meaning to make a QTDDTOT thread on /cyb/ lately though. Hopefully I'll get around to it and it becomes a bit more active.

>>301033

They're backed by company investments, endorsements, etc. Get on the train while you can. Also, ONLY INVEST IN COINS THAT HAVE UTILIY: BNB, ETH, CAKE, ATOM, XMR, defi tokens in general. You can make a killing off of erc20 tokens.

>>301096

>we already have 3 crypto threads in /cyb/ newfag

>on dead as hell boards

Do the math, Anon. This board is slow, it shouldn't bother you.

They're backed by company investments, endorsements, etc. Get on the train while you can. Also, ONLY INVEST IN COINS THAT HAVE UTILIY: BNB, ETH, CAKE, ATOM, XMR, defi tokens in general. You can make a killing off of erc20 tokens.

>>301096

>we already have 3 crypto threads in /cyb/ newfag

>on dead as hell boards

Do the math, Anon. This board is slow, it shouldn't bother you.

>>301089

You can judge a fandom's wealth buy the amout and quality of the art that comes from it. The more art and the higher quality, the more wealthy the fandom. Look at furfags, lot of them pull 6 figure salaries, and they have an unending stream of "art" that costs hundreds of dollars a piece.

You can judge a fandom's wealth buy the amout and quality of the art that comes from it. The more art and the higher quality, the more wealthy the fandom. Look at furfags, lot of them pull 6 figure salaries, and they have an unending stream of "art" that costs hundreds of dollars a piece.

>>301073

There is a section on CMC that will help you learn about crypto.

https://coinmarketcap.com/alexandria/

There is a section on CMC that will help you learn about crypto.

https://coinmarketcap.com/alexandria/

>>301073

>How is this related to Ripple and XRP?

ISO 10022

ATOM, XML, and XMR are still low. LINK blew up a few weeks ago for some reason, but it's still low based on QUANT's performance.

LINK is the only smart contract crypto currently backed by the World Economic Forum.

>How is this related to Ripple and XRP?

ISO 10022

ATOM, XML, and XMR are still low. LINK blew up a few weeks ago for some reason, but it's still low based on QUANT's performance.

LINK is the only smart contract crypto currently backed by the World Economic Forum.

>>301420

>Look at furfags, lot of them pull 6 figure salaries, and they have an unending stream of "art" that costs hundreds of dollars a piece.

And here I am struggling to find the cash to commission a plushie of my waifu. That being said, only the best will do.

>>301444

Checked and thanks.

>>301454

>ISO 10022

I assume this will be instantiated by the Flare Network? Would you say that any of those have a definitive chance of mooning or are they more likely to have a stable gain in value? Any chance of a crash?

And since we're on the topic of general advice for intoing crypto, at the risk of being told "lurk moar, newfaggot," what kind of rate of gains can one expect from investment generally, if one is competent at this sort of thing? Of course mooning isn't something I'd like to avoid, but nor would I be looking just to gamble.

>Look at furfags, lot of them pull 6 figure salaries, and they have an unending stream of "art" that costs hundreds of dollars a piece.

And here I am struggling to find the cash to commission a plushie of my waifu. That being said, only the best will do.

>>301444

Checked and thanks.

>>301454

>ISO 10022

I assume this will be instantiated by the Flare Network? Would you say that any of those have a definitive chance of mooning or are they more likely to have a stable gain in value? Any chance of a crash?

And since we're on the topic of general advice for intoing crypto, at the risk of being told "lurk moar, newfaggot," what kind of rate of gains can one expect from investment generally, if one is competent at this sort of thing? Of course mooning isn't something I'd like to avoid, but nor would I be looking just to gamble.

1613478413.png (391.6 KB, 1903x970, e70e70a829d343942e4aca1fd21879b3.png)

>>301454

>XML

Sorry, Stellar Lumens is a shitty little project that already has a too high market cap. It'll be competing with Tether to be the next stable coin, and that's if XLM gets a miraculous moonshot.

>ATOM

Great choice. Cosmos will be at the center of all things by bridging every blockchain together, essentially being the powerhouse of it all. A basic yet effective tokenomics as well (10% APY).

>XMR

Very patrician choice here too. Great for hiding your gains from the IRS; I2P and Tor networks are already throwing out Bitcoin in favor of mass adopting Monero. The Black Market has a rumored value in the trillions. Very bullish that the DHS put out over half a million to whoever cracks their system.

>>301506

Haven't followed XRP because it's a literal shitcoin that always ends up crabbing around 30-50 cents. Where are the tokenomics? If it's just a "store of value" like gold, we already have a store of value, it's called Bitcoin. LOOK FOR COINS OR TOKENS WITH TOKENOMICS, i.e. passive ways to make income, privacy coins (only Monero and Tornado Cash actually achieve thie), things that actually utilize that coin/token. The market crashing on Biblical levels in my opinion is very slim. Why? We have a new floor: retailers, companies, governments, celebrities, normalfags, they are all investing in crypto right now as we speak. We HAVE a new floor, from a psychological standpoint, just consider everything crashing again. People are going to buy the dip if they just take a second to analyze Bitcoin's price chart over the years and realize the potential. Why? BECAUSE IT ALWAYS REBOUNDS. They aren't going to squander a cheap entry. I'll tell you why we get price crashes in the first place. There are faggots called whales that sell a lot of their coins at a noticeable increment, all in hopes of crashing the coins by a few percent all in the hopes of encouraging panic selling. They sell high, and buy low after the paper hands sell. And they understand the true potential of crypto to know that accumulating as much of it will secure them a position among the elite. (Most of these crashes are actually coordinated because no one whale has nearly enough of the supply to cause a big red ticker to scare paperhanded faggots)

Now, about the gains. Your bluechips are probably your safest bet. Chances are if that crypto is on a centralized exchange (cex for short) then it's a bluechip (a safe crypto that will rise in price indefinitely). However, I need to point out that these bluechips are LONG TERM HOLDS, you don't hold them overnight and expect them to go from 1 bil marketcap to 500b.

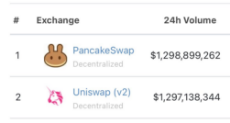

NOW, the real moonshots come from small marketcap coins with little total supply. However, these are absolutely the biggest gambles you can make in the realm of crypto. What you want to look for is something with tokenomics as mentioned above. Yield farming, liquidity pools, staking, privacy, borrowing, lending. Remember, coins and tokens going off the selling point as to being a store of value is something you want to avoid. Unless that token/coin is being accepted by vendors, retailers, etc... Monero is probably the most fungible in terms of this. Anyways, you need to know something about these early moonshots. Most of them are on the erc20 platform which built on top of the Ethereum network. But the catch is ANYONE can create their own coin which means there's tons of pajeet/chink scams going around. Another thing is the high gas fees, and since you're a newfaggot when it comes to these things it's probably best to stay away from erc20 until that skeleton faggot vitalik fixes his network. Just think, sending any stack of and erc20 token (uniswap, ethereum, sushiswap) is an easy 10 USD per transaction for the busiest hours. Want to swap 50 USD worth of coins for a different coin? You can be looking at a 100 USD gas fee. The mining cartels are absolutely making profit from this and I refuse to waste anymore eth on it until those fees are gone. So unless you have thousands to throw around or you know you'll be investing in a 3000x moonshot that'll happen within a few days, stay away from erc20. Now, most recently a new competitor has entered the competition. BNB (Binance coin) which is attempting to rival Ethereum and it's erc20 network using its very own network called the Binance Smart Chain. If you want to take the same risks as you normally would on erc20, this is absolutely the biggest move you could make right now. The gas fees are within the pennies bracket which means you can fuck up a bunch of transactions and not wince at the accidental spending. Everyone loves cheap; tell me, where do you think the normalniggers are going to go for decentralized finance (liquidity pools, yield farming, borrowing, lending)? Wherever it's cheapest with maximum returns. I recently ended up buying a nice stack of pancakeswap tokens which is currently battling it out with Uniswap in terms of volume, which is doing a pretty damn good job currently (Uniswap is currently staffed by SJW retards, so fuck them). Anyways, I put those cakes to good use 2 days ago by yield farming on pancakebunny.finance (it's going parabolic at the moment). There's some details I've left out of course, so if you have anymore questions, just ask. Anyways, important tips are obviously do your own research and look for audited platforms that have endorsements from big names or youtubers/twitter/reddit (yes reddit can actually be useful sometimes). And even then, audited and well-known platforms still come with a risk. Take Bitfinex for example: they got hacked for millions worth of Bitcoin and they were one of the top exchanges. Oh, another thing, refrain from keeping your crypto on any exchange. Put it all on a ledger/trezor, or even a desktop wallet like Exodus (Don't do exchanges on Exodus though, because Exodus are jews). Fuck niggers, fuck kikes, fuck chinks (not you CZ), and most importantly fuck niggers.

>XML

Sorry, Stellar Lumens is a shitty little project that already has a too high market cap. It'll be competing with Tether to be the next stable coin, and that's if XLM gets a miraculous moonshot.

>ATOM

Great choice. Cosmos will be at the center of all things by bridging every blockchain together, essentially being the powerhouse of it all. A basic yet effective tokenomics as well (10% APY).

>XMR

Very patrician choice here too. Great for hiding your gains from the IRS; I2P and Tor networks are already throwing out Bitcoin in favor of mass adopting Monero. The Black Market has a rumored value in the trillions. Very bullish that the DHS put out over half a million to whoever cracks their system.

>>301506

Haven't followed XRP because it's a literal shitcoin that always ends up crabbing around 30-50 cents. Where are the tokenomics? If it's just a "store of value" like gold, we already have a store of value, it's called Bitcoin. LOOK FOR COINS OR TOKENS WITH TOKENOMICS, i.e. passive ways to make income, privacy coins (only Monero and Tornado Cash actually achieve thie), things that actually utilize that coin/token. The market crashing on Biblical levels in my opinion is very slim. Why? We have a new floor: retailers, companies, governments, celebrities, normalfags, they are all investing in crypto right now as we speak. We HAVE a new floor, from a psychological standpoint, just consider everything crashing again. People are going to buy the dip if they just take a second to analyze Bitcoin's price chart over the years and realize the potential. Why? BECAUSE IT ALWAYS REBOUNDS. They aren't going to squander a cheap entry. I'll tell you why we get price crashes in the first place. There are faggots called whales that sell a lot of their coins at a noticeable increment, all in hopes of crashing the coins by a few percent all in the hopes of encouraging panic selling. They sell high, and buy low after the paper hands sell. And they understand the true potential of crypto to know that accumulating as much of it will secure them a position among the elite. (Most of these crashes are actually coordinated because no one whale has nearly enough of the supply to cause a big red ticker to scare paperhanded faggots)

Now, about the gains. Your bluechips are probably your safest bet. Chances are if that crypto is on a centralized exchange (cex for short) then it's a bluechip (a safe crypto that will rise in price indefinitely). However, I need to point out that these bluechips are LONG TERM HOLDS, you don't hold them overnight and expect them to go from 1 bil marketcap to 500b.

NOW, the real moonshots come from small marketcap coins with little total supply. However, these are absolutely the biggest gambles you can make in the realm of crypto. What you want to look for is something with tokenomics as mentioned above. Yield farming, liquidity pools, staking, privacy, borrowing, lending. Remember, coins and tokens going off the selling point as to being a store of value is something you want to avoid. Unless that token/coin is being accepted by vendors, retailers, etc... Monero is probably the most fungible in terms of this. Anyways, you need to know something about these early moonshots. Most of them are on the erc20 platform which built on top of the Ethereum network. But the catch is ANYONE can create their own coin which means there's tons of pajeet/chink scams going around. Another thing is the high gas fees, and since you're a newfaggot when it comes to these things it's probably best to stay away from erc20 until that skeleton faggot vitalik fixes his network. Just think, sending any stack of and erc20 token (uniswap, ethereum, sushiswap) is an easy 10 USD per transaction for the busiest hours. Want to swap 50 USD worth of coins for a different coin? You can be looking at a 100 USD gas fee. The mining cartels are absolutely making profit from this and I refuse to waste anymore eth on it until those fees are gone. So unless you have thousands to throw around or you know you'll be investing in a 3000x moonshot that'll happen within a few days, stay away from erc20. Now, most recently a new competitor has entered the competition. BNB (Binance coin) which is attempting to rival Ethereum and it's erc20 network using its very own network called the Binance Smart Chain. If you want to take the same risks as you normally would on erc20, this is absolutely the biggest move you could make right now. The gas fees are within the pennies bracket which means you can fuck up a bunch of transactions and not wince at the accidental spending. Everyone loves cheap; tell me, where do you think the normalniggers are going to go for decentralized finance (liquidity pools, yield farming, borrowing, lending)? Wherever it's cheapest with maximum returns. I recently ended up buying a nice stack of pancakeswap tokens which is currently battling it out with Uniswap in terms of volume, which is doing a pretty damn good job currently (Uniswap is currently staffed by SJW retards, so fuck them). Anyways, I put those cakes to good use 2 days ago by yield farming on pancakebunny.finance (it's going parabolic at the moment). There's some details I've left out of course, so if you have anymore questions, just ask. Anyways, important tips are obviously do your own research and look for audited platforms that have endorsements from big names or youtubers/twitter/reddit (yes reddit can actually be useful sometimes). And even then, audited and well-known platforms still come with a risk. Take Bitfinex for example: they got hacked for millions worth of Bitcoin and they were one of the top exchanges. Oh, another thing, refrain from keeping your crypto on any exchange. Put it all on a ledger/trezor, or even a desktop wallet like Exodus (Don't do exchanges on Exodus though, because Exodus are jews). Fuck niggers, fuck kikes, fuck chinks (not you CZ), and most importantly fuck niggers.

>>301509

>Haven't followed XRP because it's a literal shitcoin that always ends up crabbing around 30-50 cents. Where are the tokenomics?

XRP is meant to be inexpensive because it's meant for remittances and transfers. It's minimum denomination should match the average minimum currency valuation of the major adopters.

XML: Network for common centralized currencies

ATOM: Networking

XRP: Visa network backend

LINK/QUANT/ETH: Contracts

IRS says that they've managed to track XMR transactions. I doubt it, but it's stupid to try to control it.

The KYC bullshit is also stupid. Does the cashier at your corner store ask for ID before your transaction?

>Haven't followed XRP because it's a literal shitcoin that always ends up crabbing around 30-50 cents. Where are the tokenomics?

XRP is meant to be inexpensive because it's meant for remittances and transfers. It's minimum denomination should match the average minimum currency valuation of the major adopters.

XML: Network for common centralized currencies

ATOM: Networking

XRP: Visa network backend

LINK/QUANT/ETH: Contracts

IRS says that they've managed to track XMR transactions. I doubt it, but it's stupid to try to control it.

The KYC bullshit is also stupid. Does the cashier at your corner store ask for ID before your transaction?

>>301510

>XRP is meant to be inexpensive

>It's still a shitcoin

Might as well just Tether up then. Algorand is a far superior choice to that shitcoin. I'm sorry, anon. I just don't know how to put it any other way.

>>301510

>IRS says

That's all you need to know to call their bluff. They are using probabilistic methods to track Monero and even that isn't fullproof because it does a bad job most of the time. Unless they can crack ring signatures (using a breakthrough in quantum computing which means an end to privacy for good) Monero is your best bet. https://coingeek.com/ciphertrace-files-two-monero-tracing-patents/

>KYC

Well, you could download a P2P exchange like Bisq to use zelle and buy coins, but you would still need to deposit a certain amount of Ethereum to build trust on that software. There's tons of places you can buy without KYC you just have to know where to look. There's a Monero exchange that sells XMR in browser, but you pay extra since it doesn't implement smart contracts.

>XRP is meant to be inexpensive

>It's still a shitcoin

Might as well just Tether up then. Algorand is a far superior choice to that shitcoin. I'm sorry, anon. I just don't know how to put it any other way.

>>301510

>IRS says

That's all you need to know to call their bluff. They are using probabilistic methods to track Monero and even that isn't fullproof because it does a bad job most of the time. Unless they can crack ring signatures (using a breakthrough in quantum computing which means an end to privacy for good) Monero is your best bet. https://coingeek.com/ciphertrace-files-two-monero-tracing-patents/

>KYC

Well, you could download a P2P exchange like Bisq to use zelle and buy coins, but you would still need to deposit a certain amount of Ethereum to build trust on that software. There's tons of places you can buy without KYC you just have to know where to look. There's a Monero exchange that sells XMR in browser, but you pay extra since it doesn't implement smart contracts.

>>301520

Oh, right. It's "their money" so they probably own a most of the supply and can crash it on a whim.

Oh, right. It's "their money" so they probably own a most of the supply and can crash it on a whim.

>>301524

>see the future shackles being built

>don't buy them in advance to free yourself and your people

>see the future shackles being built

>don't buy them in advance to free yourself and your people

>>301530

That's okay too.

Imagine if you had a time machine and could go back to 2 years before 9/11.

You wouldn't be able to stop it, and nobody would believe you if you tried.

So what are you left to do? PROFIT.

Lease a shitty closet and over-insure it, then short airline corps. Throw some money at Diebold, Haliburton, and Blackwater after you cash out on your first two "investments".

That's okay too.

Imagine if you had a time machine and could go back to 2 years before 9/11.

You wouldn't be able to stop it, and nobody would believe you if you tried.

So what are you left to do? PROFIT.

Lease a shitty closet and over-insure it, then short airline corps. Throw some money at Diebold, Haliburton, and Blackwater after you cash out on your first two "investments".

>>301532

Alright, I definitely see what you're alluding to. But I don't know how to "profit" from this. Unless you mean to say time their rugpull correctly. No one can time the market correctly.

Alright, I definitely see what you're alluding to. But I don't know how to "profit" from this. Unless you mean to say time their rugpull correctly. No one can time the market correctly.

>>301534

>But I don't know how to "profit" from this.

ISO 20022 is centralbankcoin. They will implement the model with or without your involvment.

You profit by getting some while it's cheap and selling or using it when it's expensive.

I would also look out for a fast crypto built for ID verification with low gas prices.

>Unless you mean to say time their rugpull correctly. No one can time the market correctly.

The Rothschild family is the largest gold holder in the world. They control the flow and supply, and yet they don't dump.

This is no different. Yes, some of the current cryptos attached to 20022 could end up being trash, but it's highly unlikely that all of them will be trash. And it's even more unlikely that something which has no public mainstream adoption, yet is constantly mentioned by central bankers is garbage.

>But I don't know how to "profit" from this.

ISO 20022 is centralbankcoin. They will implement the model with or without your involvment.

You profit by getting some while it's cheap and selling or using it when it's expensive.

I would also look out for a fast crypto built for ID verification with low gas prices.

>Unless you mean to say time their rugpull correctly. No one can time the market correctly.

The Rothschild family is the largest gold holder in the world. They control the flow and supply, and yet they don't dump.

This is no different. Yes, some of the current cryptos attached to 20022 could end up being trash, but it's highly unlikely that all of them will be trash. And it's even more unlikely that something which has no public mainstream adoption, yet is constantly mentioned by central bankers is garbage.

>>301535

>You profit by getting some while it's cheap and selling or using it when it's expensive

Sounds like your ordinary swing-trading. "Buy the rumor, sell the news"-esque. Of course, this would end up taking years to see fruition. And again, you would still need to time things.

>The Rothschild family is the largest gold holder in the world.

Who said they had to give up their ownership to manipulate the price of gold? There have been some historically bad plunges when it came to the price of gold.

Anyways, not gonna be taking institutional digital currency seriously.

There are 3 main points to crypto:

1. Controlling your own wealth

2. Making some serious gains

3. Killing this Jewish financial system

Can't do the last one if you adopt digital government assets. But you're right, you can profit off of it just like any other rugpull pajeet scam you find on the erc20 platform. I just don't think it's worth it.

>You profit by getting some while it's cheap and selling or using it when it's expensive

Sounds like your ordinary swing-trading. "Buy the rumor, sell the news"-esque. Of course, this would end up taking years to see fruition. And again, you would still need to time things.

>The Rothschild family is the largest gold holder in the world.

Who said they had to give up their ownership to manipulate the price of gold? There have been some historically bad plunges when it came to the price of gold.

Anyways, not gonna be taking institutional digital currency seriously.

There are 3 main points to crypto:

1. Controlling your own wealth

2. Making some serious gains

3. Killing this Jewish financial system

Can't do the last one if you adopt digital government assets. But you're right, you can profit off of it just like any other rugpull pajeet scam you find on the erc20 platform. I just don't think it's worth it.

Okay lads.

It looks like the newest fad will be coins on the BSC network (binance's network). Because ETH's gas fees have cucked alt season hard.

Get in on BNB and other coins on the BSC like BRY and CAKE.

4/biz/ is already onto it and its only a matter of time until crypto twitter and the normies get wind of it.

It looks like the newest fad will be coins on the BSC network (binance's network). Because ETH's gas fees have cucked alt season hard.

Get in on BNB and other coins on the BSC like BRY and CAKE.

4/biz/ is already onto it and its only a matter of time until crypto twitter and the normies get wind of it.

Anyway, what do you think BTC will do? I'm of the mind that this bull run will last until summer. Just a question of whether it dumps (and how hard) before it legs up again. This liquidity and staking shit has made the market remarkable stable (relatively speaking). And BTC crabbing these past few weeks has a lot of people on edge.

>>301570

>bitcoin crashes 10k

>the dip is eaten up within a few hours

Fear naught, my fellow mumu. The mindset of every investor is now that of an accumulator. Do you honestly think they're gonna miss out on cheap internet coins when they know it's inevitable that their investment will moon in the future?

>bitcoin crashes 10k

>the dip is eaten up within a few hours

Fear naught, my fellow mumu. The mindset of every investor is now that of an accumulator. Do you honestly think they're gonna miss out on cheap internet coins when they know it's inevitable that their investment will moon in the future?

>>301569

To add onto this I've been putting money into goosedefi's EGG token.

https://www.goosedefi.com/nests

Its already pumped a bit but they plan on adding a token burn as well as a lottery, exchange, and other features.

https://goosedefi.gitbook.io/goose-finance/roadmap

Looks promising from what I've seen.

To add onto this I've been putting money into goosedefi's EGG token.

https://www.goosedefi.com/nests

Its already pumped a bit but they plan on adding a token burn as well as a lottery, exchange, and other features.

https://goosedefi.gitbook.io/goose-finance/roadmap

Looks promising from what I've seen.

OH MY FUCKING GOD LADS ETH IS GETTING FLIPPED BY BNB

There's this negro friendly bitcoin clone coming out.

https://bitcoin.black

They even have an airdrop incoming, be sure to sign up so you can dump on niggers.

https://bitcoin.black/get-coins/

https://bitcoin.black

They even have an airdrop incoming, be sure to sign up so you can dump on niggers.

https://bitcoin.black/get-coins/

>Oligarch Bill Gates Attacks Bitcoin, Cryptocurrencies

>Is there any greater endorsement of cryptocurrency?

https://bigleaguepolitics.com/oligarch-bill-gates-attacks-bitcoin-cryptocurrencies/

>Is there any greater endorsement of cryptocurrency?

https://bigleaguepolitics.com/oligarch-bill-gates-attacks-bitcoin-cryptocurrencies/

Seriously though wheres the correction?

It has to dump as some point right?

Nearly everything has fucking mooned.

It has to dump as some point right?

Nearly everything has fucking mooned.

>>301509

Noticed I haven't said thanks for typing all this out yet. I'll try to read a bit more up on it soon. Particularly interested in CEX coins, something I could just throw some cash at and not worry about for a while. Seems like a safer bet in getting into it rather than trying to analyze the daily fluctuating prices as a newb.

Noticed I haven't said thanks for typing all this out yet. I'll try to read a bit more up on it soon. Particularly interested in CEX coins, something I could just throw some cash at and not worry about for a while. Seems like a safer bet in getting into it rather than trying to analyze the daily fluctuating prices as a newb.

>>301951

It gets worse.

As more inflation hits common people, common people will look for ways to set aside money without it losing value.

Which means that easily divisible assets will inflate.

Secondary markets will form around those assets, and the feds will look to capture those markets as they form.

It gets worse.

As more inflation hits common people, common people will look for ways to set aside money without it losing value.

Which means that easily divisible assets will inflate.

Secondary markets will form around those assets, and the feds will look to capture those markets as they form.

Well it looks like I finally got the dump I was asking for.

Anyway since we're talking about coins I bought some Rubic before the pump yesterday.

It gives off chainlink type energy.

It gives off chainlink type energy.

>>302111

Good luck, I sold mine to break even. Hope you make it. In the meantime, I'll be chasing pumps and dumps.

Good luck, I sold mine to break even. Hope you make it. In the meantime, I'll be chasing pumps and dumps.

1614416046.webm (1.2 MB, Resolution:384x432 Length:00:00:51, Bitcoin Explained.webm) [play once] [loop]

Bitcoin Explained. Eventually.

Would like to keep this thread in the catalog for now.

>>301028

>>302544

(((bitcoin))) isn't truly private.

>>301144

>on dead as hell boards

dead, because of people like you who refuse to use them.

>>301896

(((they))) actually would be happy if you used bitcoin (or similar cryptocurrency) since bitcoin can be tracked/traced more than credit cards (not a joke) Perhaps Gates is looking into launching his own bitcoin clone?

>>302544

(((bitcoin))) isn't truly private.

>>301144

>on dead as hell boards

dead, because of people like you who refuse to use them.

>>301896

(((they))) actually would be happy if you used bitcoin (or similar cryptocurrency) since bitcoin can be tracked/traced more than credit cards (not a joke) Perhaps Gates is looking into launching his own bitcoin clone?

>>305308

I want to buy monero but i'm not sure how to do it safely. I have really limited trust to exchange sites and was really anxious when i had to give my data to coinbase. Since now i own crypto i was thinking about sending eth to edge and exchanging it there.

Would just buy it on Kraken but i feel somehow safer changing eth to xmr without using my bank account.

I want to buy monero but i'm not sure how to do it safely. I have really limited trust to exchange sites and was really anxious when i had to give my data to coinbase. Since now i own crypto i was thinking about sending eth to edge and exchanging it there.

Would just buy it on Kraken but i feel somehow safer changing eth to xmr without using my bank account.

1617675281.jpg (320.2 KB, 1080x2220, Screenshot_20210405-163610_Blockfolio.jpg)

R8 my stack

need to get some XMR and want some more Harmony so I can stake it for compound interest

need to get some XMR and want some more Harmony so I can stake it for compound interest

It's been a fun couple days lurking /xsg/. The price has more than doubled this past week.

Funny meme video:

[YouTube] XRP - PUMP IT UP![]()

Funny meme video:

[YouTube] XRP - PUMP IT UP

>>305734

>this is the mindset of an XRP acolyte

A relative called me this week because XRP was featured in a national news segment recently and he thought that banks were going to implement XRP as a means of transacting currency (lol sure). Boomer money must be why it's up 125% in 7 d, haha. Short it now if you can.

My stack: had BTC for a long time, bailed and went all in on BCH but I'm coming to realize that community is retarded in a different way.

>this is the mindset of an XRP acolyte

A relative called me this week because XRP was featured in a national news segment recently and he thought that banks were going to implement XRP as a means of transacting currency (lol sure). Boomer money must be why it's up 125% in 7 d, haha. Short it now if you can.

My stack: had BTC for a long time, bailed and went all in on BCH but I'm coming to realize that community is retarded in a different way.

>>305788

>>this is the mindset of an XRP acolyte

This sounds smug and I can't say I really want to take financial advice from someone that I feel doesn't respect me.

>Boomer money must be why it's up 125% in 7 d, haha.

Unlikely.

>Short it now if you can.

No.

>>this is the mindset of an XRP acolyte

This sounds smug and I can't say I really want to take financial advice from someone that I feel doesn't respect me.

>Boomer money must be why it's up 125% in 7 d, haha.

Unlikely.

>Short it now if you can.

No.

Can you recommend an exchange to work with and some coins to invest in? Preferably with arguments for why you suggest the coin?

This past year has been crazy for me since my main goal in 2020 was to buy a home. I succeeded in finding a home in a nice area and locked in a low mortgage rate, so now I don't really need to keep as much liquid capital on hand to be able to rush in and snatch up a home in this crazy market. I'm concerned about the effects of the lockdowns combined with inflation from the Federal Reserve inflating the dollar, so I'm just trying to get out of the dollar as fast as I can. I'm trying to diversify my assets across a number of different investments. Stonks, a mutual fund, and precious metals are what I've worked with so far. I feel like I probably have enough to justify investing in crypto a bit.

I don't really trust crypto. Honestly it all strikes me as a ponzi scheme or something like tulip mania. But I recognize that I have the potential to profit from it so I might as well roll the dice. At times I wonder if the crypto game is less rigged against the little guy than the stock market or other investment opportunities. It's unclear which coins that I've missed the boat on though. I feel like by the time I hear about any coin, it's already mooned and buying in would just be asking to buy high/sell low.

This past year has been crazy for me since my main goal in 2020 was to buy a home. I succeeded in finding a home in a nice area and locked in a low mortgage rate, so now I don't really need to keep as much liquid capital on hand to be able to rush in and snatch up a home in this crazy market. I'm concerned about the effects of the lockdowns combined with inflation from the Federal Reserve inflating the dollar, so I'm just trying to get out of the dollar as fast as I can. I'm trying to diversify my assets across a number of different investments. Stonks, a mutual fund, and precious metals are what I've worked with so far. I feel like I probably have enough to justify investing in crypto a bit.

I don't really trust crypto. Honestly it all strikes me as a ponzi scheme or something like tulip mania. But I recognize that I have the potential to profit from it so I might as well roll the dice. At times I wonder if the crypto game is less rigged against the little guy than the stock market or other investment opportunities. It's unclear which coins that I've missed the boat on though. I feel like by the time I hear about any coin, it's already mooned and buying in would just be asking to buy high/sell low.

>>305886

>I don't really trust crypto.

Me either, but I still trust less the (((exchanges))).

IMHO, an elegant solution to avoid them is to sell stuff while accepting crypto and then to make purchases also paying with it.

>I don't really trust crypto.

Me either, but I still trust less the (((exchanges))).

IMHO, an elegant solution to avoid them is to sell stuff while accepting crypto and then to make purchases also paying with it.

>>305886

Any cryptocurrency value is highly volatile because depends on the offer/demand relation, which is very easy to manipulate by the big players.

Now, a little detail that a very few notice is that the banksters can print money at will and buy ALL the crypto they want, not for profit, but to control and corner the market. Little guys like us are just surfing the banksters' wave.

Any cryptocurrency value is highly volatile because depends on the offer/demand relation, which is very easy to manipulate by the big players.

Now, a little detail that a very few notice is that the banksters can print money at will and buy ALL the crypto they want, not for profit, but to control and corner the market. Little guys like us are just surfing the banksters' wave.

>>305888

>IMHO, an elegant solution to avoid them is to sell stuff while accepting crypto and then to make purchases also paying with it.

I suppose I kind of did that back in 2017 when I upgraded my PC with a 1080ti and decided to play around with having it mine crypto for some mining pools for a few months. It generated ~$700 of BTC before income rates died down and I quit messing around with it since I got fed up with keeping track of it for taxes. I never bothered fucking around with an exchange to cash the BTC out or buy more crypto with my USD. I just ignored it for a few years and now the BTC in my wallet is worth ~$4k.

>IMHO, an elegant solution to avoid them is to sell stuff while accepting crypto and then to make purchases also paying with it.

I suppose I kind of did that back in 2017 when I upgraded my PC with a 1080ti and decided to play around with having it mine crypto for some mining pools for a few months. It generated ~$700 of BTC before income rates died down and I quit messing around with it since I got fed up with keeping track of it for taxes. I never bothered fucking around with an exchange to cash the BTC out or buy more crypto with my USD. I just ignored it for a few years and now the BTC in my wallet is worth ~$4k.

>>305886

>Can you recommend an exchange to work with and some coins to invest in

Since you're american you need to use coinbase to transfer from FIAT to crypto. If you're thinking long term just throw some money at shit like BTC, XMR, LINK, ETH and let it sit for a few years. Chasing shitcoin pumps is much riskier and you'll want to look up tutorials on how to use shit like MetaMask. Just remember, not your keys not your coins. AND ALWAYS FUCKING BACK UP YOUR SEED PHRASE WRITE IT DOWN AND PUT IT IN A SAFE.

I'd say we're about over half way into this cycles bull market as well. If you want to wait to buy in at a low then wait for all the coins to crash 80-90% in a few months/half a year and then buy in then.

>Can you recommend an exchange to work with and some coins to invest in

Since you're american you need to use coinbase to transfer from FIAT to crypto. If you're thinking long term just throw some money at shit like BTC, XMR, LINK, ETH and let it sit for a few years. Chasing shitcoin pumps is much riskier and you'll want to look up tutorials on how to use shit like MetaMask. Just remember, not your keys not your coins. AND ALWAYS FUCKING BACK UP YOUR SEED PHRASE WRITE IT DOWN AND PUT IT IN A SAFE.

I'd say we're about over half way into this cycles bull market as well. If you want to wait to buy in at a low then wait for all the coins to crash 80-90% in a few months/half a year and then buy in then.

>Bitcoin is a Ponzi Scheme

>"BTC is a total ponzi, going up because of new money, much from the printing press, coming in. And it will go down when money printing ends, which seems to be around now."

https://www.henrymakow.com/2021/04/migchels-bitcoin-is-a-ponzi-scheme.html

>"BTC is a total ponzi, going up because of new money, much from the printing press, coming in. And it will go down when money printing ends, which seems to be around now."

https://www.henrymakow.com/2021/04/migchels-bitcoin-is-a-ponzi-scheme.html

Simple question: how will you use crypto-currencies when the internet is (((temporarily shut down)))?

>>305969

After seeing what god damn fucking dogecoin did these past few days, I'm wondering if I should just batten down the hatches instead? I'm reminded of an anecdote from just before the great depression. The story goes that some big shot wallstreet mogul met some wageslave normalfag. In some versions of the story the worker is a shoe shiner, and in another he is an elevator attendant. Regardless, the worker's profession makes the mogul a captive audience to the worker for a few minutes. The worker makes small talk by talking about his stock portfolio and inquiring if the veteran investor has any advice for a new investor. Upon hearing about the worker's investments, the mogul becomes panicked as he realizes that the jig is up. He quickly rushed to close his positions and move his capital into safe havens. Days later the big market crash hit.

I don't know if the story is true, but that sure sounds like what's happening now. I swear, whenever I'm around a computer without an ad blocker I'm bombarded with advertisements for bitcoin credit cards and marketing apps like robinhood and webull.

After seeing what god damn fucking dogecoin did these past few days, I'm wondering if I should just batten down the hatches instead? I'm reminded of an anecdote from just before the great depression. The story goes that some big shot wallstreet mogul met some wageslave normalfag. In some versions of the story the worker is a shoe shiner, and in another he is an elevator attendant. Regardless, the worker's profession makes the mogul a captive audience to the worker for a few minutes. The worker makes small talk by talking about his stock portfolio and inquiring if the veteran investor has any advice for a new investor. Upon hearing about the worker's investments, the mogul becomes panicked as he realizes that the jig is up. He quickly rushed to close his positions and move his capital into safe havens. Days later the big market crash hit.

I don't know if the story is true, but that sure sounds like what's happening now. I swear, whenever I'm around a computer without an ad blocker I'm bombarded with advertisements for bitcoin credit cards and marketing apps like robinhood and webull.

>There Is Now A Dogecoin Billionaire Worth $15BN

>There is little we can add here that David Einhorn didn't already say yesterday, but it's probably worth noting for those keeping track of where in the bubble we are now, that in the magical world of dogecoin - a cryptocurrency that was specifically created as a joke spoof on the crypto concept and which has been promoted aggressive by such luminaries as Elon Musk - there is now a holder residing at address "DH5yaieqoZN36fDVciNyRueRGvGLR3mr7L" who owns 36,711,935,369.11 dogecoins or whatever the plural is, and whose holdings - which started accumulating back in Febriary 2019 - after the latest surge in dogegoin which has sent the joke crypto up 150% in the past 24 hours and 5x in the past week...

https://www.zerohedge.com/markets/there-now-dogegoin-billionaire-worth-15bn

>There is little we can add here that David Einhorn didn't already say yesterday, but it's probably worth noting for those keeping track of where in the bubble we are now, that in the magical world of dogecoin - a cryptocurrency that was specifically created as a joke spoof on the crypto concept and which has been promoted aggressive by such luminaries as Elon Musk - there is now a holder residing at address "DH5yaieqoZN36fDVciNyRueRGvGLR3mr7L" who owns 36,711,935,369.11 dogecoins or whatever the plural is, and whose holdings - which started accumulating back in Febriary 2019 - after the latest surge in dogegoin which has sent the joke crypto up 150% in the past 24 hours and 5x in the past week...

https://www.zerohedge.com/markets/there-now-dogegoin-billionaire-worth-15bn

>>306044

Wew wish I didn't forget my wallet password. In fact when it shows up again soon this might change quite a bit.

Well might as well try to cash out now.

Memecoin for the win good job past me.

Wew wish I didn't forget my wallet password. In fact when it shows up again soon this might change quite a bit.

Well might as well try to cash out now.

Memecoin for the win good job past me.

Cryptocurrency question

If I have 1k dollars and exchange that for Dogecoin, and both are inflated over 1 year but american dollars are inflated more than Dogecoin, does this mean I've made money by the end of that year?

If I have 1k dollars and exchange that for Dogecoin, and both are inflated over 1 year but american dollars are inflated more than Dogecoin, does this mean I've made money by the end of that year?

>>306022

Rolling brownouts/blackouts are common throughout portions of the Jew-S. Keep your e-wallets on laptops and tablets that can be easily recharged. Do not ever use (((smartphones))).

>>306077

Only IF the exchange rate is still favorable, IF you still have electricity, and IF the internet is still available. Should any of those be a "no", then you have a serious problem.

Rolling brownouts/blackouts are common throughout portions of the Jew-S. Keep your e-wallets on laptops and tablets that can be easily recharged. Do not ever use (((smartphones))).

>>306077

Only IF the exchange rate is still favorable, IF you still have electricity, and IF the internet is still available. Should any of those be a "no", then you have a serious problem.

>>306077

The taxman cares about the exchange rates at the time of your transactions to determine your capital gains.

The taxman cares about the exchange rates at the time of your transactions to determine your capital gains.

>>301537

>3. Killing this Jewish financial system

You have to be extremely naive to think they would even allow this to exist if it was a threat to their control. This is reserve psychology; they want you to think "crypto" is "beating them", when in reality it's the system they will use to replace the fiat/paper money system they've destroyed already when hyperinflation catches up. Cryptos will act as a "global currency" and do away with national ones, the plus side is they can be manipulated more easily by them now that they don't have to "print" money, it's all electronic and all purchases are electronically logged (something that was impossible with cash). They destroyed Germany in WW2 because Hitler went outside of their financial control.

>3. Killing this Jewish financial system

You have to be extremely naive to think they would even allow this to exist if it was a threat to their control. This is reserve psychology; they want you to think "crypto" is "beating them", when in reality it's the system they will use to replace the fiat/paper money system they've destroyed already when hyperinflation catches up. Cryptos will act as a "global currency" and do away with national ones, the plus side is they can be manipulated more easily by them now that they don't have to "print" money, it's all electronic and all purchases are electronically logged (something that was impossible with cash). They destroyed Germany in WW2 because Hitler went outside of their financial control.

>“It’s Totally Insane. Someone Made A Million On Dogecoin With His Stimulus Check"

https://www.zerohedge.com/markets/its-totally-insane-someone-made-million-dogecoin-his-stimulus-check

https://www.zerohedge.com/markets/its-totally-insane-someone-made-million-dogecoin-his-stimulus-check

>>306340

Wait until people forget about it and it drops back down to near nothing again, put a small amount of money in, and just hang onto it until it randomly pumps again.

Wait until people forget about it and it drops back down to near nothing again, put a small amount of money in, and just hang onto it until it randomly pumps again.

>Bitcoin Is a ‘Boon for Surveillance’, Says Former CIA Director

>Blockchain technology is underutilized as a "forensic tool," argues Michael Morell in a new report

https://truthunmuted.org/bitcoin-is-a-boon-for-surveillance-says-former-cia-director/

https://decrypt.co/66411/cia-bitcoin-surveillance

>Blockchain technology is underutilized as a "forensic tool," argues Michael Morell in a new report

https://truthunmuted.org/bitcoin-is-a-boon-for-surveillance-says-former-cia-director/

https://decrypt.co/66411/cia-bitcoin-surveillance

>>306559

Unironically this policy would be bullish for Bitcoin, and the only losers would be people dumb enough to use it for illegal transactions on the assumption that crypto is automatically untraceable.

Unironically this policy would be bullish for Bitcoin, and the only losers would be people dumb enough to use it for illegal transactions on the assumption that crypto is automatically untraceable.

>No, Dogecoin Does Not Compete With Bitcoin

>Medium of exchange and store of value are very different products.

https://cryptoeconomy.substack.com/p/no-dogecoin-does-not-compete-with

>Medium of exchange and store of value are very different products.

https://cryptoeconomy.substack.com/p/no-dogecoin-does-not-compete-with

>CEO of a Turkish Crypto Exchange Thodex Reportedly Runs Off With $2 Billion

>Nearly 400,000 users of a Turkish cryptocurrency exchange were left out of their accounts without being able to withdraw their funds. The platform’s website has been down for several days, while reports suggest its CEO has already fled the country with up to $2 billion.

https://cryptopotato.com/ceo-of-a-turkish-crypto-exchange-thodex-reportedly-runs-off-with-2-billion/

https://twitter.com/FeraSY1/status/1384929504984973314

>Nearly 400,000 users of a Turkish cryptocurrency exchange were left out of their accounts without being able to withdraw their funds. The platform’s website has been down for several days, while reports suggest its CEO has already fled the country with up to $2 billion.

https://cryptopotato.com/ceo-of-a-turkish-crypto-exchange-thodex-reportedly-runs-off-with-2-billion/

https://twitter.com/FeraSY1/status/1384929504984973314

>Second Turkish Crypto Exchange Collapses, Four Employees Arrested On Suspicion Of Fraud

>Just days after major Turkish Crypto exchange Thodex collapsed, its CEO fled with a rumored $2 billion (and was reportedly detained) and dozens of people were arrested, Turkey’s cryptocurrency investors were dealt another blow as second big exchange collapsed.

>In a statement posted late Friday on its website, Vebitcoin said it halted operations citing deteriorating financial conditions claiming that unspecified financial strain led to the decision — possibly caused by an unusually high number of withdrawals leading up to Turkey’s forthcoming cryptocurrency ban, according to CoinTelegraph.

https://www.zerohedge.com/crypto/second-turkish-crypto-exchange-collapses-four-employees-arrested-suspicion-fraud

>Just days after major Turkish Crypto exchange Thodex collapsed, its CEO fled with a rumored $2 billion (and was reportedly detained) and dozens of people were arrested, Turkey’s cryptocurrency investors were dealt another blow as second big exchange collapsed.

>In a statement posted late Friday on its website, Vebitcoin said it halted operations citing deteriorating financial conditions claiming that unspecified financial strain led to the decision — possibly caused by an unusually high number of withdrawals leading up to Turkey’s forthcoming cryptocurrency ban, according to CoinTelegraph.

https://www.zerohedge.com/crypto/second-turkish-crypto-exchange-collapses-four-employees-arrested-suspicion-fraud

>Be me

>Buy a bunch of discount bitcoins in my sleep

>Now I have a bunch of bitcoins in my sleep

Wat do?

>Buy a bunch of discount bitcoins in my sleep

>Now I have a bunch of bitcoins in my sleep

Wat do?

1619686518_1.jpg (99.5 KB, 1024x588, bitcoin-and-future-space-cover-1024x588.jpg)

Is Bitcoin/Crypto/Blockchain a Trojan Horse to Usher in a Cashless Society Control Grid?

[YouTube] Is Bitcoin/Crypto/Blockchain a Trojan Horse to Usher in a Cashless Society Control Grid?![]()

Mirror: https://odysee.com/@johnbushlivefreenow:c/is-bitcoin-crypto-blockchain-a-trojan:f

[YouTube] Is Bitcoin/Crypto/Blockchain a Trojan Horse to Usher in a Cashless Society Control Grid?

Mirror: https://odysee.com/@johnbushlivefreenow:c/is-bitcoin-crypto-blockchain-a-trojan:f

1619710042_2.jpg (143.0 KB, 636x904, 4a5913170ae1e866782d0711c4eb0cc877a01818.jpg)

I think the best crypto to buy right at THIS INSTANT is XLM, but overall I think XRP is going to be the best buy over time.

>it's centralized!

It isn't.

>they're being sued by the SEC!

Worse case scenario they pay a billion dollar fine and life goes on.

>It's a banker coin!

Yeah - who the fuck do you think has all the money?

Outside of crypto, I think the best available opportunity is in physical silver. They've been using more silver than is physically produced every year, and the stockpiles have to be draining somewhere. Silver is needed in every TV; every car; every rocket, bomb, and munition - and all the big banks are mega-short silver in order to keep prices artificially low for the industrials.

>it's centralized!

It isn't.

>they're being sued by the SEC!

Worse case scenario they pay a billion dollar fine and life goes on.

>It's a banker coin!

Yeah - who the fuck do you think has all the money?

Outside of crypto, I think the best available opportunity is in physical silver. They've been using more silver than is physically produced every year, and the stockpiles have to be draining somewhere. Silver is needed in every TV; every car; every rocket, bomb, and munition - and all the big banks are mega-short silver in order to keep prices artificially low for the industrials.

Would someponer be willing to say if it's a good time to buy now? Lurking /biz/ some people are saying alts are going to crash 90% due to BTC getting dropped by Tesla and others are saying we need to get all the crypto we can to prep for the threat of massive amounts of inflation looming. Maybe wait a little for the bear market to settle in? Just how long would that take?

>>308374

>Would someponer be willing to say if it's a good time to buy now?

No responsible poner will say that.

Crypto is a pyramid scheme and little foals like us have no clue what the big players are doing. As you already should know the value fluctuates by offer/demand relations, that means that big traders can buy and dump huge amounts of crypto and therefore to drive its value artificially. It is a game pretty similar to the Stock Market casino.

>Would someponer be willing to say if it's a good time to buy now?

No responsible poner will say that.

Crypto is a pyramid scheme and little foals like us have no clue what the big players are doing. As you already should know the value fluctuates by offer/demand relations, that means that big traders can buy and dump huge amounts of crypto and therefore to drive its value artificially. It is a game pretty similar to the Stock Market casino.

>>308393

Take in count that non-stop raising values are fueled by new comers in the game who buy, buy and buy.

I should add that governments have the upper hand to regulate or proscribe crypto because by clamping down, or better yet, taking over the exchanges can block, seize, and steal using taxation, those private tokens.

Also, to take into account is the actual answer the following question: Can I buy food with crypto?

Take in count that non-stop raising values are fueled by new comers in the game who buy, buy and buy.

I should add that governments have the upper hand to regulate or proscribe crypto because by clamping down, or better yet, taking over the exchanges can block, seize, and steal using taxation, those private tokens.

Also, to take into account is the actual answer the following question: Can I buy food with crypto?

>>308374

Big institutions are working hard to create FUD around crypto to get a bigger discount, while recently getting private access on defi protocols like Aave. You tell me? Christ, can't you do ANY research by yourself? Safest bet is BTC or ETH if you want to buy in right now.

>>305444

>ONE

Vaporwave, basically not being used by any big players. Just a way to cope if you missed Ethereum.

>RVN

Again, another coping mechanism for anyone who missed Bitcoin.

>RLC

Vaporwave, there can only be one oracle coin, and that would be Link.

Link and MAYBE BTT are the only good things in your portfolio.

>b-but it pumps!

Most big investors are interested in the widely known bluechips, not 'literal who' tokens. What do you think happens to those coins in a bear market when these untapped institutional markets are busy adopting high caps? Don't mean to fud, it's great that you made some money, but I believe only the true bluechips with nocoiner adoption will be the safest in the longterm until the next halving cycle.

Big institutions are working hard to create FUD around crypto to get a bigger discount, while recently getting private access on defi protocols like Aave. You tell me? Christ, can't you do ANY research by yourself? Safest bet is BTC or ETH if you want to buy in right now.

>>305444

>ONE

Vaporwave, basically not being used by any big players. Just a way to cope if you missed Ethereum.

>RVN

Again, another coping mechanism for anyone who missed Bitcoin.

>RLC

Vaporwave, there can only be one oracle coin, and that would be Link.

Link and MAYBE BTT are the only good things in your portfolio.

>b-but it pumps!

Most big investors are interested in the widely known bluechips, not 'literal who' tokens. What do you think happens to those coins in a bear market when these untapped institutional markets are busy adopting high caps? Don't mean to fud, it's great that you made some money, but I believe only the true bluechips with nocoiner adoption will be the safest in the longterm until the next halving cycle.

>Goldman MD Quits After Making Fortune Off Dogecoin

>The Guardian and the website efinancialcareers reported that Aziz McMahon, a former managing director and head of emerging market sales at Goldman Sachs, resigned from the investment bank - and gave up one of the most prestigious jobs in the world of finance - after earning the windfall of a lifetime off a cryptocurrency created as a joke back in 2013, and which has seen a massive runup so far this year. The exact size of McMahon's alleged crypto-fortune wasn't disclosed, other than the fact that he made "millions of dollars". The cryptocurrency is up more than 1,00% in 2021, though it has fallen more than 30% since the start of the week, and was recently trading at 47 cents.

>Coinciding with the worst selloff in doge since the start of its remarkable runup this year, news of the executive's decision to resign with his "f**k you" crypto money quickly captivated the attention of social media users, while many seized the opportunity to try and pump. Doge is down more than 30% so far this week.

https://www.zerohedge.com/markets/goldman-md-quits-after-making-fortune-dogecoin

I might be wrong, but it t looks like Elon Musk is a friend or partner of this guy, by tweeting "DOGE" a lot of normies bought the coin and the price went to the sky, then was the right moment to dump Doge and retire with the money invested for those new comers.

>The Guardian and the website efinancialcareers reported that Aziz McMahon, a former managing director and head of emerging market sales at Goldman Sachs, resigned from the investment bank - and gave up one of the most prestigious jobs in the world of finance - after earning the windfall of a lifetime off a cryptocurrency created as a joke back in 2013, and which has seen a massive runup so far this year. The exact size of McMahon's alleged crypto-fortune wasn't disclosed, other than the fact that he made "millions of dollars". The cryptocurrency is up more than 1,00% in 2021, though it has fallen more than 30% since the start of the week, and was recently trading at 47 cents.

>Coinciding with the worst selloff in doge since the start of its remarkable runup this year, news of the executive's decision to resign with his "f**k you" crypto money quickly captivated the attention of social media users, while many seized the opportunity to try and pump. Doge is down more than 30% so far this week.

https://www.zerohedge.com/markets/goldman-md-quits-after-making-fortune-dogecoin

I might be wrong, but it t looks like Elon Musk is a friend or partner of this guy, by tweeting "DOGE" a lot of normies bought the coin and the price went to the sky, then was the right moment to dump Doge and retire with the money invested for those new comers.

>>308397

>Christ, can't you do ANY research by yourself?

Have you read my post or were you just looking for someone to take your anger out on?

>Christ, can't you do ANY research by yourself?

Have you read my post or were you just looking for someone to take your anger out on?

>>308401

Lurking /biz/ isn't doing "research". And yes, I was also looking to simultaneously vent my anger while providing a little insight.

Lurking /biz/ isn't doing "research". And yes, I was also looking to simultaneously vent my anger while providing a little insight.

>>308403

No. Also, my points still stands. If you're getting your research from /biz/ you unironically have a NGMI mentality and will take on massive losses.

No. Also, my points still stands. If you're getting your research from /biz/ you unironically have a NGMI mentality and will take on massive losses.

>>308404

You've told me nothing I haven't learned from lurking /biz/ already, and I'm not your emotional punching bag. Kindly grow up please.

You've told me nothing I haven't learned from lurking /biz/ already, and I'm not your emotional punching bag. Kindly grow up please.

>>308406

>Lurking /biz/ some people are saying alts are going to crash 90% due to BTC getting dropped by Tesla

You don't belong in crypto if you think there's a good chance that will happen anytime soon, I'm gonna clue you in since you're so obviously pathetic and can't take criticism without flinching too hard: https://bowtiedbull.substack.com/

>Lurking /biz/ some people are saying alts are going to crash 90% due to BTC getting dropped by Tesla

You don't belong in crypto if you think there's a good chance that will happen anytime soon, I'm gonna clue you in since you're so obviously pathetic and can't take criticism without flinching too hard: https://bowtiedbull.substack.com/

>>308407

>Acting like a nigger

Okay buddy, maybe you ought to take a break from the internet for a little while, how about it.

>Acting like a nigger

Okay buddy, maybe you ought to take a break from the internet for a little while, how about it.

1620950798.mp4 (4.8 MB, Resolution:576x1024 Length:00:00:15, I have a unicorn.mp4) [play once] [loop]

>>308408

>thinks im acting like a nigger

Just trying to give some advice to an obvious nocoiner who has never invested a single time in their life. Not sure how you conflate that with "acting like a nigger". Bull cycles typically last 1.5 years, we're not even half way in, and you're panicking over a 10% drop, which is quite common in a volatile market. NGMI.

>thinks im acting like a nigger

Just trying to give some advice to an obvious nocoiner who has never invested a single time in their life. Not sure how you conflate that with "acting like a nigger". Bull cycles typically last 1.5 years, we're not even half way in, and you're panicking over a 10% drop, which is quite common in a volatile market. NGMI.

>>308413

>>thinks im acting like a nigger

You most definitely were.

>Just trying to give some advice to an obvious nocoiner who has never invested a single time in their life.

Is that a fact.

>Not sure how you conflate that with "acting like a nigger".

Flying off the handle after I had politely signaled that I didn't want to deal with whatever issues you've got going on.

>Bull cycles typically last 1.5 years, we're not even half way in, and you're panicking over a 10% drop, which is quite common in a volatile market.

Okay then, fair enough.

>NGMI.

I guess we'll see about that won't we.

>>thinks im acting like a nigger

You most definitely were.

>Just trying to give some advice to an obvious nocoiner who has never invested a single time in their life.

Is that a fact.

>Not sure how you conflate that with "acting like a nigger".

Flying off the handle after I had politely signaled that I didn't want to deal with whatever issues you've got going on.

>Bull cycles typically last 1.5 years, we're not even half way in, and you're panicking over a 10% drop, which is quite common in a volatile market.

Okay then, fair enough.

>NGMI.

I guess we'll see about that won't we.

>>308423

If you don't know what to do, just DCA, it isn't hard.

>Is that a fact.

Yes, it's so obvious that you're new to the crypto game simply because you talk like every other paper-handed faggot, which, let's be honest, we don't need anymore of those in this market. Excuse my brash behavior, but you need to lose the ego.

If you don't know what to do, just DCA, it isn't hard.

>Is that a fact.

Yes, it's so obvious that you're new to the crypto game simply because you talk like every other paper-handed faggot, which, let's be honest, we don't need anymore of those in this market. Excuse my brash behavior, but you need to lose the ego.

>>308463

>n-no! you cant just criticize me for being a dumb fucking newfaggot who has a holier-than-thou attitude and cant stand it when others with more experience give me advice!

Not sure if you're the same person or not since the bloated pussy keeps changing IDs, but you're both going to neck it when you buy the top and sell the bottom trying to swing trade. It's almost a wet dream for me since you both talk like you have small-dick trifecta.

>n-no! you cant just criticize me for being a dumb fucking newfaggot who has a holier-than-thou attitude and cant stand it when others with more experience give me advice!

Not sure if you're the same person or not since the bloated pussy keeps changing IDs, but you're both going to neck it when you buy the top and sell the bottom trying to swing trade. It's almost a wet dream for me since you both talk like you have small-dick trifecta.

>>308465