This is a thread to talk about the politics of the Federal Reserve Bank and any other central banks under the banking cartel. End the Fed

/mlpol/ - My Little Politics

Archived thread

1561468006.jpg (55.4 KB, 576x345, 2EADF83E-9BBB-49A8-960D-20E3B7CDC022.jpeg)

1561474329_2.jpg (53.6 KB, 850x400, ron paul federal reserve legalized counterfeit.jpg)

1561474329_5.jpg (78.6 KB, 850x400, Rothbard Federal Reserve quote.jpg)

End the Fed and all other central banks and abolish fiat currency. They exist to coordinate inflation of the money supply, raising prices and enriching banksters and governments at the expense of everyone else. Without this inflationary scheme, birthrates would also be higher as it wouldn't be so costly for people to save for the future, and without prices constantly rising, mothers could stay home and raise their children. And without the Fed, the government would not be able to finance its endless Zionist wars and gibs.

1562920331.jpg (202.4 KB, 1280x720, BB00C37A-1FC7-4F82-A677-28BC2BACB25E.jpeg)

>‘US$ is the only real currency!’ Trump demands banking regulation of bitcoin, Facebook’s Libra

https://www.rt.com/business/463972-trump-cryptocurrency-real-dollar/

Never go full jews

https://www.rt.com/business/463972-trump-cryptocurrency-real-dollar/

Never go full jews

Can some one explain to me why the fed and fiat currency is bad? Any time I ask I've never gotten a good answer out of anyone before. Its like nobody actually knows how its supposed to tie into everything. I don't really have an opinion on the matter because I don't feel like I know much about the topics aside from the stuff I learned in pubic school.

Regarding fiat currency I know somewhat more about that than the fed. I know from history that the gold standard was around for a long time. I know that in the 1800s the Populists tried to challenge it with bimetallism so that they could increase the money supply. At the time any increase in inflation was a good thing for them because they wanted to pay back debts to bankers more easily. I know they failed. I don't know when we went off the gold standard either. I've always been traditionally taught that fiat currency isn't bad because it allows for credit that makes economic growth possible. Most people I know seem to think it is less stable but that we would be unable to go back to the gold standard or use bimetallism without curbing economic growth. If we got rid of fiat currency wouldn't the money supply get tight and despite low inflation wouldn't it be hard for normal people to access capital? Big gaps in my knowledge there, but how is fiat currency worse than the alternatives?

The federal bank is even more of a mystery. I've heard a lot about how its bad/good but I can't explain why it is one or another. Doesn't the fed simply monitor interest rates, loan to banks, and mandate how much currency must be kept in bank reserves? Aren't those positive stabilizing effects on the banking system? Is the fed colluding with big banks or mismanaging the system? Again I don't really know much here but I'm going off of the "traditional narrative" I've always been taught in schooling.

Regarding fiat currency I know somewhat more about that than the fed. I know from history that the gold standard was around for a long time. I know that in the 1800s the Populists tried to challenge it with bimetallism so that they could increase the money supply. At the time any increase in inflation was a good thing for them because they wanted to pay back debts to bankers more easily. I know they failed. I don't know when we went off the gold standard either. I've always been traditionally taught that fiat currency isn't bad because it allows for credit that makes economic growth possible. Most people I know seem to think it is less stable but that we would be unable to go back to the gold standard or use bimetallism without curbing economic growth. If we got rid of fiat currency wouldn't the money supply get tight and despite low inflation wouldn't it be hard for normal people to access capital? Big gaps in my knowledge there, but how is fiat currency worse than the alternatives?

The federal bank is even more of a mystery. I've heard a lot about how its bad/good but I can't explain why it is one or another. Doesn't the fed simply monitor interest rates, loan to banks, and mandate how much currency must be kept in bank reserves? Aren't those positive stabilizing effects on the banking system? Is the fed colluding with big banks or mismanaging the system? Again I don't really know much here but I'm going off of the "traditional narrative" I've always been taught in schooling.

>>231923

As I understand it, the FED is a private bank that issues its own money. So, the American government and the people are lending and using paper printed by some jews. Such paper has no intrinsic value (fiat currency), it is only paper with a arbitrary number printed on it telling the people its value and there is nothing tangible to back it up (for example gold).

The great con job here is that the government doesn't need the kike bank at all, because the government can print its own money and avoid to pay interests (usury) to the jews.

So, why not to print its own money and regain independence? The answer is simple and brutal, Adolf Hitler did it and he was at war with every jew capital of the world at that time: New York, London, and Moscow. Libyan leader Muammar Gaddafi tried too recently and he was assassinated; Saddam Hussein tried to circumvent the FED's dollar selling Iraq's oil for euros, and war destroyed his country.

Independence from the (((banksters))) is not something easily achievable.

As I understand it, the FED is a private bank that issues its own money. So, the American government and the people are lending and using paper printed by some jews. Such paper has no intrinsic value (fiat currency), it is only paper with a arbitrary number printed on it telling the people its value and there is nothing tangible to back it up (for example gold).

The great con job here is that the government doesn't need the kike bank at all, because the government can print its own money and avoid to pay interests (usury) to the jews.

So, why not to print its own money and regain independence? The answer is simple and brutal, Adolf Hitler did it and he was at war with every jew capital of the world at that time: New York, London, and Moscow. Libyan leader Muammar Gaddafi tried too recently and he was assassinated; Saddam Hussein tried to circumvent the FED's dollar selling Iraq's oil for euros, and war destroyed his country.

Independence from the (((banksters))) is not something easily achievable.

>>231927

https://www.bankofcanada.ca/wp-content/uploads/2010/07/dollar_book.pdf

This will tell you all you need to know about the history of money.

https://www.bankofcanada.ca/wp-content/uploads/2010/07/dollar_book.pdf

This will tell you all you need to know about the history of money.

>>231923

The Federal Reserve System is an unholy alliance of the banks and the state. The banks benefit because the Fed allows them to coordinate inflation of the money supply by setting the reserve rate (the lower the reserve rate, the more all the banks can inflate) and expanding the base supply of money the banks can inflate upon. It also bails them out when they get themselves in trouble. It benefits the state because the Fed will buy any debt the government has (in the form of bonds) and use it to increase the money supply, meaning the state always has a willing funder for its wars and welfare, whereas taxpayers might object to explicit tax increases (ultimately, they end up paying anyway, through lost value of savings and increased prices.) This system also creates recessions and depressions through its credit expansion. In regards to your question about economic growth, it's worth noting that the 1880s were a period of strong economic growth coupled with decreasing money supply. I might articulate more fully on the problems with the Fed later.

The Federal Reserve System is an unholy alliance of the banks and the state. The banks benefit because the Fed allows them to coordinate inflation of the money supply by setting the reserve rate (the lower the reserve rate, the more all the banks can inflate) and expanding the base supply of money the banks can inflate upon. It also bails them out when they get themselves in trouble. It benefits the state because the Fed will buy any debt the government has (in the form of bonds) and use it to increase the money supply, meaning the state always has a willing funder for its wars and welfare, whereas taxpayers might object to explicit tax increases (ultimately, they end up paying anyway, through lost value of savings and increased prices.) This system also creates recessions and depressions through its credit expansion. In regards to your question about economic growth, it's worth noting that the 1880s were a period of strong economic growth coupled with decreasing money supply. I might articulate more fully on the problems with the Fed later.

A History of Central Banking and the Enslavement of Mankind

Written by a banking whistleblower, this is mandatory /pol/ reading

Written by a banking whistleblower, this is mandatory /pol/ reading

Central banking was a good idea in the days of gold-backed currencies but the fiat-money and the keynesian economy and the goal of inflation have such negative effect that it should be dealt with immediately. We should hang those responsible.

>>231998

1st gold.standard did not last for long and did address the UK pound dominance which was enslaving the world.

2nd the FED is run very differently to other central banks. I might diss.dr.carney but the BoE decision are well justified and have kept things stable and kept confidence in the market. Much of this can be attributed to the decision to make BoE independant of political interferance. The FED is not in the same position because of hand.shake nepotism.

3rd I would agree that 2% global inflation target fucks up natural econimics and causes a permanent divide between rich.poor. That target is imposed politically so you should not blame central banks for the enslavement. You should blame democratic.masturbatory insanity.

1st gold.standard did not last for long and did address the UK pound dominance which was enslaving the world.

2nd the FED is run very differently to other central banks. I might diss.dr.carney but the BoE decision are well justified and have kept things stable and kept confidence in the market. Much of this can be attributed to the decision to make BoE independant of political interferance. The FED is not in the same position because of hand.shake nepotism.

3rd I would agree that 2% global inflation target fucks up natural econimics and causes a permanent divide between rich.poor. That target is imposed politically so you should not blame central banks for the enslavement. You should blame democratic.masturbatory insanity.

>>232036

oh and I still believe that a currency backed by something is far better than a currency backed by nothing, that inflation robs the people of there wealth, that keynesian economics (thought up by socialists by the way) is pure cancer and that the people responsible should be hanged

look at what is happening in europe

oh and I still believe that a currency backed by something is far better than a currency backed by nothing, that inflation robs the people of there wealth, that keynesian economics (thought up by socialists by the way) is pure cancer and that the people responsible should be hanged

look at what is happening in europe

>>232038

Plenty of stuff on.line can explain better than me. Although all currencies are measured against the dollar now the pound is still the most traded daily. That is largely because of the London Stock Exchange having a very large portfolio and people needing the pound to trade on it.

What is happening recently since 2016 is that because of the vote to leave Europe the BoE decided not to gradually raise interest rates and has effectively stalled the UK economy ready to re.start once a deal.or.not has been finalised. This has meant the pound value is about 10% below its true worth. Those with money trade on that week.on.week via political.speech and timed.forecasts. They are essentially fluctuating the pound value more than in the past and skimming of the cream. Three years of this is doing serious damage to the UK economy. It is however expected that once the politics is settled that the pound will re.set at a higher value. Personally I think three years of damage may not be as simple a recovery as others do. However in global terms trump.china is more of a concern. The good thing the BoE has managed is that if the world goes into collapse the UK and pound is robust enough to suffer a 15% loss of total GDP. The norm for other countries.currrncies is 1% including the dollar. The UK would be top.dog but that scenario is vey unlikely.

Plenty of stuff on.line can explain better than me. Although all currencies are measured against the dollar now the pound is still the most traded daily. That is largely because of the London Stock Exchange having a very large portfolio and people needing the pound to trade on it.

What is happening recently since 2016 is that because of the vote to leave Europe the BoE decided not to gradually raise interest rates and has effectively stalled the UK economy ready to re.start once a deal.or.not has been finalised. This has meant the pound value is about 10% below its true worth. Those with money trade on that week.on.week via political.speech and timed.forecasts. They are essentially fluctuating the pound value more than in the past and skimming of the cream. Three years of this is doing serious damage to the UK economy. It is however expected that once the politics is settled that the pound will re.set at a higher value. Personally I think three years of damage may not be as simple a recovery as others do. However in global terms trump.china is more of a concern. The good thing the BoE has managed is that if the world goes into collapse the UK and pound is robust enough to suffer a 15% loss of total GDP. The norm for other countries.currrncies is 1% including the dollar. The UK would be top.dog but that scenario is vey unlikely.

1563692259.mp4 (23.5 MB, Resolution:1280x720 Length:00:00:57, The Jewish Question - Julius Streicher (1936).mp4) [play once] [loop]

>>231927

>(((The FED)))

>War

>Independence from the (((banksters))) is not something easily achievable.

>(((The FED)))

>War

>Independence from the (((banksters))) is not something easily achievable.

>>231927

>As I understand it, the FED is a private bank that issues its own money. So, the American government and the people are lending and using paper printed by some jews. Such paper has no intrinsic value (fiat currency), it is only paper with a arbitrary number printed on it telling the people its value and there is nothing tangible to back it up (for example gold).

That doesn't explain why the common arguments for fiat currency are wrong, isn't the value derived from the political and economic stability of the US government. Wasn't the gold standard abandoned because having money value fixed to gold meant the money supply was too limited? If there is only so much gold then can't your economy only support so much wealth?

>The great con job here is that the government doesn't need the kike bank at all, because the government can print its own money and avoid to pay interests (usury) to the jews.

So the government is paying interest on money the fed is printing for it? How so?

>So, why not to print its own money and regain independence? The answer is simple and brutal, Adolf Hitler did it and he was at war with every jew capital of the world at that time: New York, London, and Moscow.

I'm no expert on the banking system in the third reich, but Hitler wanted to achieve autarky. Jewish institutions boycotted Germany, but trying to achieve autarky destroyed Germany economically. Autarky would guarantee independence from international jewish finance (capitalism) but Germany never could of supported itself in autarky. As soon as the foreign currency reserves dried up Germany HAD to invade other countries or face economic ruin. Hitler chose to break from the capitalistic economic system and go socialist. I get why he did that but it doesn't mean an economic war was declared on Nazi Germany that caused its destruction. To get German "out" of the depression the Nazis used social spending, public works, and rearmament programs paid for with money form assets they liquidated or didn't have.

>>231945

That sounds about right, but didn't the pre-fed era have its own problems? I always hear bank runs being mentioned during the era. I don't know if the fed has anything to do with that or if it was fixed by instating the FDIC. Sure the 1880s were good but the depression of the 1870s was almost as bad as the Great Depression. Ideally how would the system work without the fed? Same as the old system but with some of the post depression laws like the FDIC still in effect or something entirely new?

So is the problem with the fed that its too comfy with the banks and the government? The original intent was that the fed would keep banks from going up and destroying people's money? Instead the banks are able to rely on the fed helping them so much that they can get away with poor management and risky practices? This is because the fed will loan to them or alter interest rates to "save" them?

>As I understand it, the FED is a private bank that issues its own money. So, the American government and the people are lending and using paper printed by some jews. Such paper has no intrinsic value (fiat currency), it is only paper with a arbitrary number printed on it telling the people its value and there is nothing tangible to back it up (for example gold).

That doesn't explain why the common arguments for fiat currency are wrong, isn't the value derived from the political and economic stability of the US government. Wasn't the gold standard abandoned because having money value fixed to gold meant the money supply was too limited? If there is only so much gold then can't your economy only support so much wealth?

>The great con job here is that the government doesn't need the kike bank at all, because the government can print its own money and avoid to pay interests (usury) to the jews.

So the government is paying interest on money the fed is printing for it? How so?

>So, why not to print its own money and regain independence? The answer is simple and brutal, Adolf Hitler did it and he was at war with every jew capital of the world at that time: New York, London, and Moscow.

I'm no expert on the banking system in the third reich, but Hitler wanted to achieve autarky. Jewish institutions boycotted Germany, but trying to achieve autarky destroyed Germany economically. Autarky would guarantee independence from international jewish finance (capitalism) but Germany never could of supported itself in autarky. As soon as the foreign currency reserves dried up Germany HAD to invade other countries or face economic ruin. Hitler chose to break from the capitalistic economic system and go socialist. I get why he did that but it doesn't mean an economic war was declared on Nazi Germany that caused its destruction. To get German "out" of the depression the Nazis used social spending, public works, and rearmament programs paid for with money form assets they liquidated or didn't have.

>>231945

That sounds about right, but didn't the pre-fed era have its own problems? I always hear bank runs being mentioned during the era. I don't know if the fed has anything to do with that or if it was fixed by instating the FDIC. Sure the 1880s were good but the depression of the 1870s was almost as bad as the Great Depression. Ideally how would the system work without the fed? Same as the old system but with some of the post depression laws like the FDIC still in effect or something entirely new?

So is the problem with the fed that its too comfy with the banks and the government? The original intent was that the fed would keep banks from going up and destroying people's money? Instead the banks are able to rely on the fed helping them so much that they can get away with poor management and risky practices? This is because the fed will loan to them or alter interest rates to "save" them?

>>232315

I waited for some volunteer to come forward to engage you perhaps in some kind of hegelian argument, even if the matter is economics.

The theme at hand is vast and hard to cleanly unfold without to define precisely terms like "value", "currency", "stability", "scarcity", "output", "labor", and so on.

My knowledge of macro economics is good, but not so good to confront a seasoned commie loaded with (((Das Kapital))) under the arm, which I suspect you are.

So to make things brief and not let this thread die without some basic answers, let me give you some canned ones, even if that will earn me the title of NPC. Sorry to disappoint you, or perhaps to confirm that that you think already know, but I am not in the mood to type a wall of text.

>So the government is paying interest on money the fed is printing for it? How so?

It is called serving the debt.

The jews print the money and the world, not just USA, must pay them the mandatory usury for their gentleness.

>I'm no expert on the banking system in the third reich

OK, there is plenty of disinformation published by the kikes and their golems, let me point to alternative sources:

1- International Capitalism: How Money is Created

https://www.bitchute.com/video/Xsp9EnwyACFO/ <--- (General info about how it works)

2- NSDAP Social Philosophy and Economic Theory

https://www.bitchute.com/video/UDagBiD4Gqo/ <--- (You must watch this one. It is normie friendly)

>but didn't the pre-fed era have its own problems?

It is not about difficulties, but control and who extract resources from the rest.

I waited for some volunteer to come forward to engage you perhaps in some kind of hegelian argument, even if the matter is economics.

The theme at hand is vast and hard to cleanly unfold without to define precisely terms like "value", "currency", "stability", "scarcity", "output", "labor", and so on.

My knowledge of macro economics is good, but not so good to confront a seasoned commie loaded with (((Das Kapital))) under the arm, which I suspect you are.

So to make things brief and not let this thread die without some basic answers, let me give you some canned ones, even if that will earn me the title of NPC. Sorry to disappoint you, or perhaps to confirm that that you think already know, but I am not in the mood to type a wall of text.

>So the government is paying interest on money the fed is printing for it? How so?

It is called serving the debt.

The jews print the money and the world, not just USA, must pay them the mandatory usury for their gentleness.

>I'm no expert on the banking system in the third reich

OK, there is plenty of disinformation published by the kikes and their golems, let me point to alternative sources:

1- International Capitalism: How Money is Created

https://www.bitchute.com/video/Xsp9EnwyACFO/ <--- (General info about how it works)

2- NSDAP Social Philosophy and Economic Theory

https://www.bitchute.com/video/UDagBiD4Gqo/ <--- (You must watch this one. It is normie friendly)

>but didn't the pre-fed era have its own problems?

It is not about difficulties, but control and who extract resources from the rest.

>>232395

>The jews print the money

And before some light thinking heads point out that sovereign governments print their own currency, let me mention that central banks have the mission "to control" such sovereignty.

>The jews print the money

And before some light thinking heads point out that sovereign governments print their own currency, let me mention that central banks have the mission "to control" such sovereignty.

I've deleted two different responses I thought up, so I'll make this one simple. I'm not a communist. I'd like to be indignant about being called a communist just because I don't buy into nat soc economics, but I'm sure if I got defensive about it you'd just cite that as "proof" you "called me out" correctly. I appreciate that despite your belief in me being a communist, you did provide some responses even if they are understandably short. I skimmed a bit of the second video and the author is citing "Wages of Destruction" so it can't be that bad. I'll make time to watch it. All of this boils down to how much and to what degree either of us believe the jews control the world. It has been argued about in the tech monopoly thread in the past so I'll just drop it here because it will simply retread the same ground again. I'd also like to point out that I'm still not even denying the fed is a bad thing. Hence the questions at the end. Americans have resisted a federal bank since Jacksonian times, they couldn't of done it for no reason.

This is the video that discusses many of the concepts I'm arguing for why National Socialist economics were poor prior to the first world war. I'm not getting my rhetoric from Das Kapital or the Communist Manifesto.

https://www.bitchute.com/video/PQGMjDQ-TJ8/

This is the video that discusses many of the concepts I'm arguing for why National Socialist economics were poor prior to the first world war. I'm not getting my rhetoric from Das Kapital or the Communist Manifesto.

https://www.bitchute.com/video/PQGMjDQ-TJ8/

>>232315

>That doesn't explain why the common arguments for fiat currency are wrong, isn't the value derived from the political and economic stability of the US government. Wasn't the gold standard abandoned because having money value fixed to gold meant the money supply was too limited? If there is only so much gold then can't your economy only support so much wealth?

Value is derived from how much people consider the thing to be valuable. Some people value chips highly versus dollars and will pay $5 for a bag of chips; others value them lowly and will pay only $0.50. Because there are lots of people buying chips and lots of people making chips, the price tends to equalize around the amount which people would purchase and producers would sell.

The problem with fiat is that it is utterly arbitrary and can be changed willy-nilly. Contrary to what mainstream sources claim, currency is not the source of wealth but only its measure. It doesn't matter how much money is in circulation because there is a fixed supply of real resources.

With a relatively fixed supply of currency, prices will remain stable or will slowly drop as money will be worth more in relation to a growing amount of goods. This encourages saving and investment. Keynesians consider this disastrous. They and the other side of the (((economic dialectic))), neo-classicals, want the money supply to be controlled by a central bank.

The central bank can adjust the money supply in three ways. Mainly, though, it buys or sells bonds on the open market. It buys treasury notes from the (((member banks))) in exchange for free money. The goal is to provide "liquidity" to the market. However, what happens is the (((banks))) use the new currency at current prices, reaping full benefits. The next one who had received the currency in exchange finds prices to be slightly higher, but still has a net benefit. And on and on, until the prices have risen in response to the injection, and after that point the rise in prices will have outpaced any individual benefit. Average consumers get shafted because by the time they see any increase in income (such as in wage increase), they've already had to deal with higher prices for some time.

A Fedkike explains how it works himself: https://www.youtube.com/watch?v=XX2_vel-i5I

>So the government is paying interest on money the fed is printing for it? How so?

Whenever the government goes into debt (which is all the time) it issues a treasury note (https://www.investopedia.com/terms/t/treasurybill.asp). It's a bond, meaning in exchange for money now, it will pay the complete amount in a specified amount of time plus interest. Individuals, corporations, and even governments can purchase these notes. When the Federal Reserve "prints" money, it's simply taking these notes and exchanging them with credit which can be exchanged for cash. This has the side effect of lowering the interest rate because there are fewer bonds in circulation and therefore less competition to get people to pick them up.

(https://www.thebalance.com/how-is-the-fed-monetizing-debt-3306126)

>That sounds about right, but didn't the pre-fed era have its own problems? I always hear bank runs being mentioned during the era. I don't know if the fed has anything to do with that or if it was fixed by instating the FDIC. Sure the 1880s were good but the depression of the 1870s was almost as bad as the Great Depression. Ideally how would the system work without the fed? Same as the old system but with some of the post depression laws like the FDIC still in effect or something entirely new?

People tend to forget that states had their own banks which engaged in similar practices to the modern Fed, albeit in a far less sophisticated manner. Here's a pretty good rebuttal for your argument. https://tomwoods.com/ep-418-the-truth-about-one-of-those-pre-fed-depressions/

t. economics major

>That doesn't explain why the common arguments for fiat currency are wrong, isn't the value derived from the political and economic stability of the US government. Wasn't the gold standard abandoned because having money value fixed to gold meant the money supply was too limited? If there is only so much gold then can't your economy only support so much wealth?

Value is derived from how much people consider the thing to be valuable. Some people value chips highly versus dollars and will pay $5 for a bag of chips; others value them lowly and will pay only $0.50. Because there are lots of people buying chips and lots of people making chips, the price tends to equalize around the amount which people would purchase and producers would sell.

The problem with fiat is that it is utterly arbitrary and can be changed willy-nilly. Contrary to what mainstream sources claim, currency is not the source of wealth but only its measure. It doesn't matter how much money is in circulation because there is a fixed supply of real resources.

With a relatively fixed supply of currency, prices will remain stable or will slowly drop as money will be worth more in relation to a growing amount of goods. This encourages saving and investment. Keynesians consider this disastrous. They and the other side of the (((economic dialectic))), neo-classicals, want the money supply to be controlled by a central bank.

The central bank can adjust the money supply in three ways. Mainly, though, it buys or sells bonds on the open market. It buys treasury notes from the (((member banks))) in exchange for free money. The goal is to provide "liquidity" to the market. However, what happens is the (((banks))) use the new currency at current prices, reaping full benefits. The next one who had received the currency in exchange finds prices to be slightly higher, but still has a net benefit. And on and on, until the prices have risen in response to the injection, and after that point the rise in prices will have outpaced any individual benefit. Average consumers get shafted because by the time they see any increase in income (such as in wage increase), they've already had to deal with higher prices for some time.

A Fedkike explains how it works himself: https://www.youtube.com/watch?v=XX2_vel-i5I

>So the government is paying interest on money the fed is printing for it? How so?

Whenever the government goes into debt (which is all the time) it issues a treasury note (https://www.investopedia.com/terms/t/treasurybill.asp). It's a bond, meaning in exchange for money now, it will pay the complete amount in a specified amount of time plus interest. Individuals, corporations, and even governments can purchase these notes. When the Federal Reserve "prints" money, it's simply taking these notes and exchanging them with credit which can be exchanged for cash. This has the side effect of lowering the interest rate because there are fewer bonds in circulation and therefore less competition to get people to pick them up.

(https://www.thebalance.com/how-is-the-fed-monetizing-debt-3306126)

>That sounds about right, but didn't the pre-fed era have its own problems? I always hear bank runs being mentioned during the era. I don't know if the fed has anything to do with that or if it was fixed by instating the FDIC. Sure the 1880s were good but the depression of the 1870s was almost as bad as the Great Depression. Ideally how would the system work without the fed? Same as the old system but with some of the post depression laws like the FDIC still in effect or something entirely new?

People tend to forget that states had their own banks which engaged in similar practices to the modern Fed, albeit in a far less sophisticated manner. Here's a pretty good rebuttal for your argument. https://tomwoods.com/ep-418-the-truth-about-one-of-those-pre-fed-depressions/

t. economics major

1563947359.jpg (108.8 KB, 800x800, 0299715f0fea650500585efb9842a9d5dc.jpg)

>>232411

>National Socialist economics were poor prior to the first world war.

NatSoc came to power in 1933, 15 years after the end of WWI.

>This is the video that discusses many of the concepts...

To begin with, at 3:55 and 4:20 the talker says that Hitler was evil.

At 4:00 he calls Hitler a failed artist, meaning he is parroting jewish bullshit and never saw Hitler's works; seriously.

And many other statements that are just "character assassination" made to fit with the conscious collective imprinted by the jews on the population (meaning jewish propaganda).

The talker says that food and commerce where the a determinant issue, which is a dumb explanation.

There were many DEEPER factors at play, such the financing not only of Hitler's movement, but also the german technological sector by (((Wall Street))), and the "official" arrangement with the zionists to evacuate the german jews to Madagascar and later to Palestine before the war.

From the above many people jumped to the conclusion that Uncle Adolf was a (((banksters)))' plant; however facts refute that. The Gestapo assisted by the SS were tasked to destroy every Freemason and similar zionist' spearhead organizations, some members of the Rothschild family were taken into custody and released after the payment of a colossal bounty, and even one or two died in prison.

So, to make it short, the video is plenty of incorrect and misleading assessments. It is bull crap for the brainwashed normie tier chump.

And for you, I suggest to lurk moar. The redpilling is slow and have to be ingested in small doses.

>National Socialist economics were poor prior to the first world war.

NatSoc came to power in 1933, 15 years after the end of WWI.

>This is the video that discusses many of the concepts...

To begin with, at 3:55 and 4:20 the talker says that Hitler was evil.

At 4:00 he calls Hitler a failed artist, meaning he is parroting jewish bullshit and never saw Hitler's works; seriously.

And many other statements that are just "character assassination" made to fit with the conscious collective imprinted by the jews on the population (meaning jewish propaganda).

The talker says that food and commerce where the a determinant issue, which is a dumb explanation.

There were many DEEPER factors at play, such the financing not only of Hitler's movement, but also the german technological sector by (((Wall Street))), and the "official" arrangement with the zionists to evacuate the german jews to Madagascar and later to Palestine before the war.

From the above many people jumped to the conclusion that Uncle Adolf was a (((banksters)))' plant; however facts refute that. The Gestapo assisted by the SS were tasked to destroy every Freemason and similar zionist' spearhead organizations, some members of the Rothschild family were taken into custody and released after the payment of a colossal bounty, and even one or two died in prison.

So, to make it short, the video is plenty of incorrect and misleading assessments. It is bull crap for the brainwashed normie tier chump.

And for you, I suggest to lurk moar. The redpilling is slow and have to be ingested in small doses.

>>232420

>NatSoc came to power in 1933, 15 years after the end of WWI.

My mistake, I meant to type the second world war not the first.

>To begin with, at 3:55 and 4:20 the talker says that Hitler was evil.

At 4:00 he calls Hitler a failed artist, meaning he is parroting jewish bullshit and never saw Hitler's works; seriously.

And many other statements that are just "character assassination" made to fit with the conscious collective imprinted by the jews on the population (meaning jewish propaganda).

That is understandable, but a key point that he is also trying to drive home is that Hitler was not a madman. Even if he personally thinks Hitler's policies were "evil" he is saying they were supported by conclusions based on logic and reason: Racial Science and what he dubs, "The Shrinking Markets Problem." The classic narrative dismisses Hitler's "logic" because socialists and moderates are afraid people will turn into Nazis if they also hear and believe his reasoning. It is the same reason communists what to convince people fascists and national socialists are interchangeable. They don't want people to see how they are different and potentially adopt their ideas.

I've watched the first hour of that documentary so far and it is as accurate as I can tell. The author is obviously interpreting National Socialist economics from a positive lens, but he is acknowledging where problems did exist in the Reich economy. Its worth noting that if you subscribe to classical liberal individualistic values, many "positives" of the National Socialist economy are "negatives" and visa versa. I don't find Hitler's social programs particularly negative, but I'll hold on any further comment until I get around to watching the other hour and a half.

>>232419

Thanks, that's really informative. Whenever I asked my gen ed econ professor about why people hate the fed he couldn't really give me as substantial of a answer. This makes much more sense. I'm a history guy so most of my history professors aren't very good with economics but the few econ professors I've got weren't as great with economic history either. Usually they are just biz types.

>NatSoc came to power in 1933, 15 years after the end of WWI.

My mistake, I meant to type the second world war not the first.

>To begin with, at 3:55 and 4:20 the talker says that Hitler was evil.

At 4:00 he calls Hitler a failed artist, meaning he is parroting jewish bullshit and never saw Hitler's works; seriously.

And many other statements that are just "character assassination" made to fit with the conscious collective imprinted by the jews on the population (meaning jewish propaganda).

That is understandable, but a key point that he is also trying to drive home is that Hitler was not a madman. Even if he personally thinks Hitler's policies were "evil" he is saying they were supported by conclusions based on logic and reason: Racial Science and what he dubs, "The Shrinking Markets Problem." The classic narrative dismisses Hitler's "logic" because socialists and moderates are afraid people will turn into Nazis if they also hear and believe his reasoning. It is the same reason communists what to convince people fascists and national socialists are interchangeable. They don't want people to see how they are different and potentially adopt their ideas.

I've watched the first hour of that documentary so far and it is as accurate as I can tell. The author is obviously interpreting National Socialist economics from a positive lens, but he is acknowledging where problems did exist in the Reich economy. Its worth noting that if you subscribe to classical liberal individualistic values, many "positives" of the National Socialist economy are "negatives" and visa versa. I don't find Hitler's social programs particularly negative, but I'll hold on any further comment until I get around to watching the other hour and a half.

>>232419

Thanks, that's really informative. Whenever I asked my gen ed econ professor about why people hate the fed he couldn't really give me as substantial of a answer. This makes much more sense. I'm a history guy so most of my history professors aren't very good with economics but the few econ professors I've got weren't as great with economic history either. Usually they are just biz types.

>>232476

Here I found more info about NatSoc economics from one of /ourguys/, VertigoPolitix. His channel have been deleted as well many mirrors of his videos, but some are still up.

German War Against Globalism, part 1

https://www.youtube.com/watch?v=rf3JGmnkwNY

German War Against Globalism Part 2

https://www.youtube.com/watch?v=NRQEAbPVImE

Here I found more info about NatSoc economics from one of /ourguys/, VertigoPolitix. His channel have been deleted as well many mirrors of his videos, but some are still up.

German War Against Globalism, part 1

https://www.youtube.com/watch?v=rf3JGmnkwNY

German War Against Globalism Part 2

https://www.youtube.com/watch?v=NRQEAbPVImE

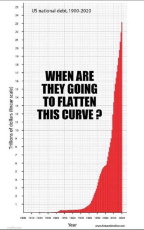

>>231923

>>232395

>>232419

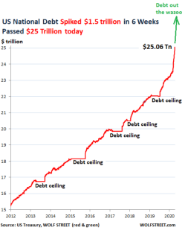

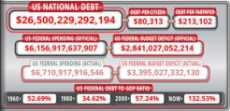

>debt

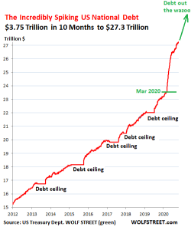

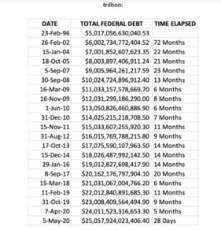

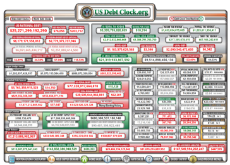

>Endgame: Starting In 2024, All US Debt Issuance Will Be Used To Pay Only For Interest On Debt

https://www.zerohedge.com/news/2019-07-31/endgame-starting-2024-all-us-debt-issuance-will-be-used-pay-only-interest-debt

>>232395

>>232419

>debt

>Endgame: Starting In 2024, All US Debt Issuance Will Be Used To Pay Only For Interest On Debt

https://www.zerohedge.com/news/2019-07-31/endgame-starting-2024-all-us-debt-issuance-will-be-used-pay-only-interest-debt

>>233738

As I see it, there are two choices.

1- We enter into a new era (NWO) where countries gave sovereignty to international capital because they own us, meaning we will be "officially" ruled by a corporation, or…

2- We witness a revolution where nations' will are reinstated and oligarchs and associated golems are gutted.

As I see it, there are two choices.

1- We enter into a new era (NWO) where countries gave sovereignty to international capital because they own us, meaning we will be "officially" ruled by a corporation, or…

2- We witness a revolution where nations' will are reinstated and oligarchs and associated golems are gutted.

The whole subject is weird and every time I think I got it I run into contradictions.

None the less I still think that fiat money, keynesianism and (monetary) inflation have much more downsides than upsides.

None the less I still think that fiat money, keynesianism and (monetary) inflation have much more downsides than upsides.

1566010002.jpg (214.3 KB, 2048x1504, D1CC616C-4CD0-42EA-B1D7-CBAC651970F0.jpeg)

1568102963.mp4 (2.3 MB, Resolution:480x480 Length:00:01:55, Godfrey Bloom exposes the banking scam.mp4) [play once] [loop]

Godfrey Bloom exposes the banking scam.

1568160077.mp4 (6.6 MB, Resolution:854x480 Length:00:04:04, Ron Paul warns of Federal Reserve messing with US elections.mp4) [play once] [loop]

>Ron Paul warns of Federal Reserve messing with US elections

https://www.bitchute.com/video/kbMaRC2C3tho/

https://www.bitchute.com/video/kbMaRC2C3tho/

1569263547.jpg (220.1 KB, 1200x1500, FFDA1BA8-15B5-4623-A4B1-F4CAA8777E6C.jpeg)

He seems to be another Zionist jew. He’s always hanging around the war hawks like Pompeo, You don’t see HUD secretary Ben Carlson war hawking.

1571299470_2.mp4 (15.2 MB, Resolution:640x480 Length:00:08:00, The original white extremist.mp4) [play once] [loop]

>The original white extremist

https://www.bitchute.com/video/734Zk3MoGu87/

The Jews, the Fed, our enslavement.

https://www.bitchute.com/video/734Zk3MoGu87/

The Jews, the Fed, our enslavement.

The financial system, explained by Ken O'Keefe.

Fed Up Preacher Explains to his Congregation the Usurious Federal Reserve System.

Tweet saved at https://archive.li/nBYro

1583231056.mp4 (4.7 MB, Resolution:854x480 Length:00:02:57, Jews tried to bribe Members of BNP to ignore Jewish Banking system.mp4) [play once] [loop]

>UK

>Jews tried to bribe Members of BNP Party to ignore Jewish Banking system

>Jews tried to bribe Members of BNP Party to ignore Jewish Banking system

>NWO Magick: A Faux ‘Pandemic’, And A Very, Very Real Financial Collapse

>Let nobody tell you the current financial meltdown is about ‘the Corona virus’. The Collapse began September 27th last year, when the repo market’s interest-rate spiked to 10% and the Fed had to restart bailing out the Banks on the repo market every night. They have ceased lending to each other since then. The Fed has also been monetizing most of the massive Trump Deficit. Nobody else is buying Treasuries.

>Meanwhile: there is no ‘pandemic’. A handful of oldies are dying of what’s looking like a nasty flu. Their average age of death is 81 in Italy. 79 in Holland. Their numbers are minute: in Holland we’re talking about 40 deaths up till now. Still, the whole country is grinding to a standstill, not because of the ‘virus’ and ‘sick people’, but because of the insane overreaction by the Government.

https://realcurrencies.wordpress.com/2020/03/18/nwo-magick-a-faux-pandemic-and-a-very-very-real-financial-collapse/

>Let nobody tell you the current financial meltdown is about ‘the Corona virus’. The Collapse began September 27th last year, when the repo market’s interest-rate spiked to 10% and the Fed had to restart bailing out the Banks on the repo market every night. They have ceased lending to each other since then. The Fed has also been monetizing most of the massive Trump Deficit. Nobody else is buying Treasuries.

>Meanwhile: there is no ‘pandemic’. A handful of oldies are dying of what’s looking like a nasty flu. Their average age of death is 81 in Italy. 79 in Holland. Their numbers are minute: in Holland we’re talking about 40 deaths up till now. Still, the whole country is grinding to a standstill, not because of the ‘virus’ and ‘sick people’, but because of the insane overreaction by the Government.

https://realcurrencies.wordpress.com/2020/03/18/nwo-magick-a-faux-pandemic-and-a-very-very-real-financial-collapse/

1584948257_1.webm (6.0 MB, Resolution:854x470 Length:00:01:25, Financial Expert - Central Banks Fostering Global Collapse.webm) [play once] [loop]

1584948257_2.webm (5.0 MB, Resolution:854x470 Length:00:01:27, Financial Expert - Central Banks Fostering Global Collapse - mason.webm) [play once] [loop]

-Corona-Chan is a scripted event for the transition to a global currency and one government.

-With massive bailouts for the private sector the the merge of corporations with the State is sealed, which it's the definition of fascism.

-Small and medium enterprises are being swept by the economic shutdown and the monopoly of the big corporations is paved.

-A cashless society and total control on the population is next.

-Resistance will be smashed.

-And the interview ends with the disclaimer that the interviewee is a 32 degree mason and "mason are your friends". I kid you not.

>Financial Expert: Central Banks Fostering Global Collapse By Design

https://www.youtube.com/watch?v=P33HS9D8Grs

-With massive bailouts for the private sector the the merge of corporations with the State is sealed, which it's the definition of fascism.

-Small and medium enterprises are being swept by the economic shutdown and the monopoly of the big corporations is paved.

-A cashless society and total control on the population is next.

-Resistance will be smashed.

-And the interview ends with the disclaimer that the interviewee is a 32 degree mason and "mason are your friends". I kid you not.

>Financial Expert: Central Banks Fostering Global Collapse By Design

https://www.youtube.com/watch?v=P33HS9D8Grs

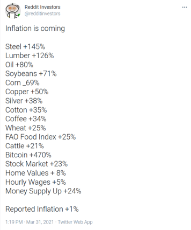

>Federal Reserve Announces Unlimited Money Printing Operations

>In the long term, this makes the existing money in circulation less valuable because they’re creating more of it on their computers.

>If this continues, it will be more economical to use paper currency as toilet paper than actual toilet paper. This is something that actually happened in Zimbabwe.

https://infostormer.com/federal-reserve-announces-unlimited-money-printing-operations/

Inflation is the poor's tax.

>In the long term, this makes the existing money in circulation less valuable because they’re creating more of it on their computers.

>If this continues, it will be more economical to use paper currency as toilet paper than actual toilet paper. This is something that actually happened in Zimbabwe.

https://infostormer.com/federal-reserve-announces-unlimited-money-printing-operations/

Inflation is the poor's tax.

1585170223_1.mp4 (14.8 MB, Resolution:640x360 Length:00:06:20, NWO Cashless Digital Currency.mp4) [play once] [loop]

>>263855

>inflation

But they have the solution to the chaos and robbery created by themselves ---> digital currency. The Fed will reinvent itself and (((masters))) will have control on every single transaction. Expect your assets to be frozen and seized if you step out of the line.

Clip: NWO Cashless Digital Currency Silently Slipped into CV Stimulus Bill.

>inflation

But they have the solution to the chaos and robbery created by themselves ---> digital currency. The Fed will reinvent itself and (((masters))) will have control on every single transaction. Expect your assets to be frozen and seized if you step out of the line.

Clip: NWO Cashless Digital Currency Silently Slipped into CV Stimulus Bill.

>Deep Economic Suffering Has Erupted All Over America, But Guess Who The Fed Is Helping?

>As millions upon millions of Americans lose their jobs in the greatest wave of unemployment in U.S. history, the Federal Reserve has decided that now is the time to spend trillions of newly created dollars in a desperate attempt to protect financial asset values.

>In other words, as much of the country suddenly plunges into poverty, the Federal Reserve is working exceedingly hard to protect the wealth of the elite.

>Approximately fifty percent of all stock market wealth is owned by the wealthiest one percent of all Americans, and the amount of stock market wealth owned by the poorest 50 percent of all Americans is so small that it really doesn’t matter. And those running the Fed certainly understand that their reckless policies will create very painful inflation that will hit average American families extremely hard, but they don’t seem to care.

>At this point, they figure that asset values must be protected at all costs, and that is going to continue to expand the absolutely massive gap between the rich and the poor in this country.

https://www.zerohedge.com/personal-finance/deep-economic-suffering-has-erupted-all-over-america-guess-who-fed-helping

>As millions upon millions of Americans lose their jobs in the greatest wave of unemployment in U.S. history, the Federal Reserve has decided that now is the time to spend trillions of newly created dollars in a desperate attempt to protect financial asset values.

>In other words, as much of the country suddenly plunges into poverty, the Federal Reserve is working exceedingly hard to protect the wealth of the elite.

>Approximately fifty percent of all stock market wealth is owned by the wealthiest one percent of all Americans, and the amount of stock market wealth owned by the poorest 50 percent of all Americans is so small that it really doesn’t matter. And those running the Fed certainly understand that their reckless policies will create very painful inflation that will hit average American families extremely hard, but they don’t seem to care.

>At this point, they figure that asset values must be protected at all costs, and that is going to continue to expand the absolutely massive gap between the rich and the poor in this country.

https://www.zerohedge.com/personal-finance/deep-economic-suffering-has-erupted-all-over-america-guess-who-fed-helping

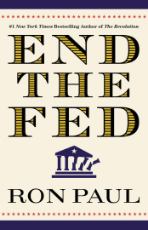

So, I am a total brainlet when it comes to the FED and the central banking system. Is End the Fed a good book to get? I would appreciate other book recommendations as well.

>>266057

Murray Rothbard wrote about it a lot. The Case Against the Fed,

History of Money and Banking in the United States: The Colonial Era to World War II, The Origins of the Federal Reserve, and What Has Government Done to Our Money? are all worth taking a look at, and can be found as free pdfs at mises.org

Murray Rothbard wrote about it a lot. The Case Against the Fed,

History of Money and Banking in the United States: The Colonial Era to World War II, The Origins of the Federal Reserve, and What Has Government Done to Our Money? are all worth taking a look at, and can be found as free pdfs at mises.org

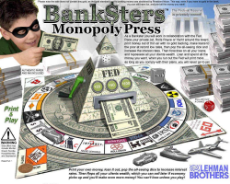

>Fractional Reserve Banking Explained - Modern Money Mechanics

>This video explains the fractional reserve banking system and the monetary policy of the Federal Reserve Bank. This is a very detailed explanation on the creation of currency within the Federal Reserve system. The inspiration for this video comes right out of the Federal Reserve's report "Modern Money Mechanics".

https://www.youtube.com/watch?v=P-5xDzTvW6E

>This video explains the fractional reserve banking system and the monetary policy of the Federal Reserve Bank. This is a very detailed explanation on the creation of currency within the Federal Reserve system. The inspiration for this video comes right out of the Federal Reserve's report "Modern Money Mechanics".

https://www.youtube.com/watch?v=P-5xDzTvW6E

This is from July 2019, and I think is relevant today.

The pieces are falling in place and the whole begins to make sense.

Populism aka nationalism is being railroaded and set up to fail. It's scripted by the kikes.

>It's Obvious Who Will Replace Trump After The Controlled Demolition Of The Economy

>In the months leading up to the 2016 election I had been predicting a Trump win based on a particular theory which I believe still holds true today – namely the theory that the global banking elites in power were allowing so-called “populist” movements in the US and Europe to gain political traction near the very end of the decade long “Everything Bubble”.

>Once populist groups were entrenched and feeling overconfident, the cabal would then tighten liquidity into existing economic weakness and crash the system on their heads. Populists would get the blame for an economic disaster that the central banks had engineered many years in advance.

>Once enough suffering had been dealt to the populace, globalists and extreme leftists would arrive on the scene to offer anti-populism as a solution; meaning the centralization and socialization of everything on a scale never before witnessed except perhaps in the darkest days of the Bolshevik Revolution.

http://www.alt-market.com/articles/3855-its-obvious-who-will-replace-trump-after-the-controlled-demolition-of-the-economy

The pieces are falling in place and the whole begins to make sense.

Populism aka nationalism is being railroaded and set up to fail. It's scripted by the kikes.

>It's Obvious Who Will Replace Trump After The Controlled Demolition Of The Economy

>In the months leading up to the 2016 election I had been predicting a Trump win based on a particular theory which I believe still holds true today – namely the theory that the global banking elites in power were allowing so-called “populist” movements in the US and Europe to gain political traction near the very end of the decade long “Everything Bubble”.

>Once populist groups were entrenched and feeling overconfident, the cabal would then tighten liquidity into existing economic weakness and crash the system on their heads. Populists would get the blame for an economic disaster that the central banks had engineered many years in advance.

>Once enough suffering had been dealt to the populace, globalists and extreme leftists would arrive on the scene to offer anti-populism as a solution; meaning the centralization and socialization of everything on a scale never before witnessed except perhaps in the darkest days of the Bolshevik Revolution.

http://www.alt-market.com/articles/3855-its-obvious-who-will-replace-trump-after-the-controlled-demolition-of-the-economy

>The entire American economy is just a facade for money-laundering’ – RT’s Keiser Report

>“Every single corporation in America pretty much just doesn’t do what it says it does. They’re gaming the system by giving you free cash from the Fed, if you’re part of the privileged class…”

>The S&P 500 is just a front for money-laundering, according to Max. “So, the entire American economy is just a facade for money-laundering at this point,” he says.

https://www.rt.com/business/492895-us-economy-money-laundering/

https://www.youtube.com/watch?v=2r0ly8Wbwo0

>“Every single corporation in America pretty much just doesn’t do what it says it does. They’re gaming the system by giving you free cash from the Fed, if you’re part of the privileged class…”

>The S&P 500 is just a front for money-laundering, according to Max. “So, the entire American economy is just a facade for money-laundering at this point,” he says.

https://www.rt.com/business/492895-us-economy-money-laundering/

https://www.youtube.com/watch?v=2r0ly8Wbwo0

>How to Take Your Money Out of the Bank Without Going to Prison

https://www.youtube.com/watch?v=Vm28hhH3vis

https://www.youtube.com/watch?v=Vm28hhH3vis

>Louis Farrakhan Exposes the Rothschilds and Bankers, 1995

>The Champion of Truth, The Honorable Minister Louis Farrakhan delivered this powerful informative message in Springfield, Mass. on 1, 1995.

>Minister Louis Farrakhans great speach in 1995 on the Rothchild family and how central bankers rule our world.

>Minister Farrakhan exposing the synogauge of Satan and its agents: The Rothschilds and Warburgs. This lecture was done during a very special Saviours Day in 1995, preceding the Million Man .

>Excerpts from a very powerful speech by The Honorable Minister Louis Farrakhan entitled, Conspiracy of the International Bankers: The Takeover of America Done 1, 1995 in Springfield,.

https://www.youtube.com/watch?v=-ff7wJTbqdc

Mirror:

>FARAKKAHN'S BEST SPEECH EVER EXPOSES ROTHSCHILDS, FEDERAL RESERVE, ADL, FBI IN 1995 SPEECH

https://www.bitchute.com/video/berW1N4ttLxd/

This muslim negro names the Jew and ALL the dirty tricks on the American People. Outstanding speech.

>The Champion of Truth, The Honorable Minister Louis Farrakhan delivered this powerful informative message in Springfield, Mass. on 1, 1995.

>Minister Louis Farrakhans great speach in 1995 on the Rothchild family and how central bankers rule our world.

>Minister Farrakhan exposing the synogauge of Satan and its agents: The Rothschilds and Warburgs. This lecture was done during a very special Saviours Day in 1995, preceding the Million Man .

>Excerpts from a very powerful speech by The Honorable Minister Louis Farrakhan entitled, Conspiracy of the International Bankers: The Takeover of America Done 1, 1995 in Springfield,.

https://www.youtube.com/watch?v=-ff7wJTbqdc

Mirror:

>FARAKKAHN'S BEST SPEECH EVER EXPOSES ROTHSCHILDS, FEDERAL RESERVE, ADL, FBI IN 1995 SPEECH

https://www.bitchute.com/video/berW1N4ttLxd/

This muslim negro names the Jew and ALL the dirty tricks on the American People. Outstanding speech.

1593499251_1.png (947.0 KB, 810x2136, uyfgbiuhoihiuyuftydrdfyghhfrdytfu.png)

1593499251_2.jpg (100.2 KB, 1024x512, federal-reserve-1913-crime.jpg)

>How the Fed Gets Away with Ripping Off Ordinary Americans

>The Federal Reserve has printed trillions of dollars without generating runaway price inflation through the use of a neat trick.

>The privately owned bank cartel shovels the bulk of the money to Wall Street banks and not to the public at large. Instead of millions of Americans rushing out to bid up prices on consumer goods, a relative handful of bankers is using the free money to bid up asset prices and then pay themselves huge performance bonuses.

>It’s quite the racket. Fed officials have been able to point at stock prices as “proof” of how they successfully engineered an economic recovery.

>Wall Street is the true beneficiary of all the largesse and Main Street doesn’t ask too many questions as long as the stock market is roaring higher.

>Things have to be good, right?

>Except now Americans noticing that Fed policy is horribly unfair. The distribution of recent stimulus funds from the Fed and Congress is so lopsided it’s outrageous. Politicians printed and borrowed roughly $6 trillion – the equivalent of $30,000 for every adult in the US.

>How much of that cash did people actually see? About $1,200 if they were eligible for assistance.

>And since Congress borrowed 100% of those funds, Americans are expected to pay it back. They’ll have to add it to their tab.

https://www.activistpost.com/2020/06/how-the-fed-gets-away-with-ripping-off-ordinary-americans.html

>The Federal Reserve has printed trillions of dollars without generating runaway price inflation through the use of a neat trick.

>The privately owned bank cartel shovels the bulk of the money to Wall Street banks and not to the public at large. Instead of millions of Americans rushing out to bid up prices on consumer goods, a relative handful of bankers is using the free money to bid up asset prices and then pay themselves huge performance bonuses.

>It’s quite the racket. Fed officials have been able to point at stock prices as “proof” of how they successfully engineered an economic recovery.

>Wall Street is the true beneficiary of all the largesse and Main Street doesn’t ask too many questions as long as the stock market is roaring higher.

>Things have to be good, right?

>Except now Americans noticing that Fed policy is horribly unfair. The distribution of recent stimulus funds from the Fed and Congress is so lopsided it’s outrageous. Politicians printed and borrowed roughly $6 trillion – the equivalent of $30,000 for every adult in the US.

>How much of that cash did people actually see? About $1,200 if they were eligible for assistance.

>And since Congress borrowed 100% of those funds, Americans are expected to pay it back. They’ll have to add it to their tab.

https://www.activistpost.com/2020/06/how-the-fed-gets-away-with-ripping-off-ordinary-americans.html

1593628538.png (268.5 KB, 1280x762, A smile make everything better.png)

>>232420

out of curiosity hitlerfag, why did hitler get pissy about his jet engineers and demand they use the tech to build bombers instead of immediately apply the technology to fighters in defense of german infrastructure? that seems like a throw too deliberate to be easily accounted for and I would like your input.

out of curiosity hitlerfag, why did hitler get pissy about his jet engineers and demand they use the tech to build bombers instead of immediately apply the technology to fighters in defense of german infrastructure? that seems like a throw too deliberate to be easily accounted for and I would like your input.

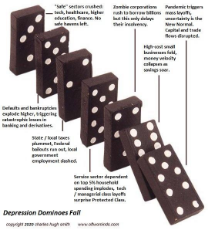

>Welcome To The Crazed, Frantic Demise Of Finance Capitalism

>The greatest scam of the past century is unraveling before our eyes. I'm calling it finance capitalism as a general descriptor of the dominant form of what's called "capitalism" because calling it what it actually is--a fraud that's destroyed the foundations of our economy and society--is, well, a much more difficult sell than "capitalism," which still has some faint echoes of the open markets, etc. that characterized traditional capitalism, which I call naive capitalism because it is incapable of differentiating between the parasitic, predatory finance version cloaking itself as "capitalism" and actual capitalism, in which capital is put at risk, markets are transparent, etc.

>The cognitive dissonance required to ignore the widening gap between the real economy and the fraud's basic machinery--speculation funded by "money" conjured out of thin air--has reached a level of denial that can only be termed psychotic.

>All bubbles pop, all frauds implode, all scams collapse. That ominous clicking coming from behind the tattered billboard is the sound of dominoes falling.

https://www.zerohedge.com/markets/welcome-crazed-frantic-demise-finance-capitalism

http://charleshughsmith.blogspot.com/2020/07/welcome-to-crazed-frantic-demise-of.html

>The greatest scam of the past century is unraveling before our eyes. I'm calling it finance capitalism as a general descriptor of the dominant form of what's called "capitalism" because calling it what it actually is--a fraud that's destroyed the foundations of our economy and society--is, well, a much more difficult sell than "capitalism," which still has some faint echoes of the open markets, etc. that characterized traditional capitalism, which I call naive capitalism because it is incapable of differentiating between the parasitic, predatory finance version cloaking itself as "capitalism" and actual capitalism, in which capital is put at risk, markets are transparent, etc.

>The cognitive dissonance required to ignore the widening gap between the real economy and the fraud's basic machinery--speculation funded by "money" conjured out of thin air--has reached a level of denial that can only be termed psychotic.

>All bubbles pop, all frauds implode, all scams collapse. That ominous clicking coming from behind the tattered billboard is the sound of dominoes falling.

https://www.zerohedge.com/markets/welcome-crazed-frantic-demise-finance-capitalism

http://charleshughsmith.blogspot.com/2020/07/welcome-to-crazed-frantic-demise-of.html

>Fedcoin: A New Scheme for Tyranny and Poverty

>If some Congress members get their way, the Federal Reserve may soon be able to track many of your purchases in real time and share that information with government agencies. This is just one of the problems with the proposed “digital dollar” or “fedcoin.”

>Fedcoin was initially included in the first coronavirus spending bill. While the proposal was dropped from the final version of the bill, there is still great interest in fedcoin on Capitol Hill. Some progressives have embraced fedcoin as a way to provide Americans with a “universal basic income.”

>Fedcoin could threaten private cryptocurrencies, increase inflation, and give government new powers over our financial transactions. Fedcoin will also speed up destruction of the fiat money system. Whatever gain fedcoin may bring to average Americans will come at terrible cost to liberty and prosperity.

http://www.ronpaulinstitute.org/archives/featured-articles/2020/july/27/fedcoin-a-new-scheme-for-tyranny-and-poverty/

>If some Congress members get their way, the Federal Reserve may soon be able to track many of your purchases in real time and share that information with government agencies. This is just one of the problems with the proposed “digital dollar” or “fedcoin.”

>Fedcoin was initially included in the first coronavirus spending bill. While the proposal was dropped from the final version of the bill, there is still great interest in fedcoin on Capitol Hill. Some progressives have embraced fedcoin as a way to provide Americans with a “universal basic income.”

>Fedcoin could threaten private cryptocurrencies, increase inflation, and give government new powers over our financial transactions. Fedcoin will also speed up destruction of the fiat money system. Whatever gain fedcoin may bring to average Americans will come at terrible cost to liberty and prosperity.

http://www.ronpaulinstitute.org/archives/featured-articles/2020/july/27/fedcoin-a-new-scheme-for-tyranny-and-poverty/

Thorough and short explanation how the financial scam works and how the money masters cause crashes and depressions to rob people's wealth.

>David Icke

>While You Were Preoccupied......

https://www.youtube.com/watch?v=8PXNAsLRh64 (10:27 long)

>David Icke

>While You Were Preoccupied......

https://www.youtube.com/watch?v=8PXNAsLRh64 (10:27 long)

>>279907

I would say this is Qanon tier stuff, but for normie web.

90% is true and 10% misdirection.

In the end, it doesn't matter if it's true or not because never ever the people mentioned or involved will be punished, what matters is the 10% meant to give the "conservatives" the false impression that "they're winning" and "the storm is coming"; so they relax and will never organize and attack the criminals.

I would say this is Qanon tier stuff, but for normie web.

90% is true and 10% misdirection.

In the end, it doesn't matter if it's true or not because never ever the people mentioned or involved will be punished, what matters is the 10% meant to give the "conservatives" the false impression that "they're winning" and "the storm is coming"; so they relax and will never organize and attack the criminals.

1597715681_1.png (24.9 KB, 491x619, US-Gross-National-Debt-2011-2020-05-06-red-.png)

1597715681_2.jpg (38.5 KB, 493x239, 344b7352d6fea80dcae02482f801cbf8.jpg)

>Century of Enslavement: The History of The Federal Reserve

https://www.youtube.com/watch?v=5IJeemTQ7Vk

Mirror: https://www.bitchute.com/video/zwdCl18pslkC/

https://www.youtube.com/watch?v=5IJeemTQ7Vk

Mirror: https://www.bitchute.com/video/zwdCl18pslkC/

A Quick Look at Fiat Currency.

>>283123

So if I understand this right (without looking at 13(3) or the transaction thingies), the SuperSpecialAccount (cpff) for relief and broader economic activities. All the cool stuff, like US dollars, foreign bucks, and ESF, ect. A National bank if you will.

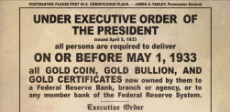

Then the Treasurer also turns the jew gold stealing powers into Exchange Stabilization Fund (TheOTHERSuperCoolAccount (esf)).

That's how they got the gold if what anon claims is true.

And IMF is held with majority shares (it's an organization company thing) in the US.

So here's the rundown.

CPFF is only held by the Treasurer, he tells the people to go get the gold using the ESF backed by previous legal previously jew powered greed.

It can get more than just gold.

Treasurer has the money.

This can go one of three ways.

This is the corner stone to create the NWO, with the US as the head. President Trump has played his plan (((they))) can't destroy the US without overhauling everything.

Or turn the US into a puppet state as they try to unfucker things.

This is another elaborate means to ensure no one is above the long arms of the Treasury.

This robs (((them))) of all their power, wealth, and ambitions. They can't fuck up anymore. No more ussery, no more US interest to the FED, US might get out of fucking debt, (((they))) lost everything of monetary value. They can't just bank roll things by ass loads of interest.

One thing is certain whoever holds the presidency, and who his treasurer is decides the fate of the US economy, the world economy, and how much influence (((they))) can gather.

This is one hell of a find.

They will lose their money by trying to continue to manipulate the world. But they are actually losing money. Not just good goy bucks, or even gold, they have to work to get that money.

That was Six Months ago.

It is now possible to starve them of (((their))) power.

So if I understand this right (without looking at 13(3) or the transaction thingies), the SuperSpecialAccount (cpff) for relief and broader economic activities. All the cool stuff, like US dollars, foreign bucks, and ESF, ect. A National bank if you will.

Then the Treasurer also turns the jew gold stealing powers into Exchange Stabilization Fund (TheOTHERSuperCoolAccount (esf)).

That's how they got the gold if what anon claims is true.

And IMF is held with majority shares (it's an organization company thing) in the US.

So here's the rundown.

CPFF is only held by the Treasurer, he tells the people to go get the gold using the ESF backed by previous legal previously jew powered greed.

It can get more than just gold.

Treasurer has the money.

This can go one of three ways.

This is the corner stone to create the NWO, with the US as the head. President Trump has played his plan (((they))) can't destroy the US without overhauling everything.

Or turn the US into a puppet state as they try to unfucker things.

This is another elaborate means to ensure no one is above the long arms of the Treasury.

This robs (((them))) of all their power, wealth, and ambitions. They can't fuck up anymore. No more ussery, no more US interest to the FED, US might get out of fucking debt, (((they))) lost everything of monetary value. They can't just bank roll things by ass loads of interest.

One thing is certain whoever holds the presidency, and who his treasurer is decides the fate of the US economy, the world economy, and how much influence (((they))) can gather.

This is one hell of a find.

They will lose their money by trying to continue to manipulate the world. But they are actually losing money. Not just good goy bucks, or even gold, they have to work to get that money.

That was Six Months ago.

It is now possible to starve them of (((their))) power.

>>283123

By the half of those posts, I stopped reading.

There's plenty of "WE" and that's absurd because only (((them))) matter and have all the cards in the game. "WE" are spectators and outsiders at best and meant to take the brunt of the debt owed to the banksters.

As long as people don't understand that playing the Rothschild game of finance is a lose-lose situation for everybody except (((them))) nothing will change.

Opting out from the kike financial system and to conduct trade by bartering or alternative methods is the path for freedom. Hitler did it and 5 five years Germany reborn in a mighty powerhouse.

By the half of those posts, I stopped reading.

There's plenty of "WE" and that's absurd because only (((them))) matter and have all the cards in the game. "WE" are spectators and outsiders at best and meant to take the brunt of the debt owed to the banksters.

As long as people don't understand that playing the Rothschild game of finance is a lose-lose situation for everybody except (((them))) nothing will change.

Opting out from the kike financial system and to conduct trade by bartering or alternative methods is the path for freedom. Hitler did it and 5 five years Germany reborn in a mighty powerhouse.

>The Circle Is Complete: BOJ Joins Fed And ECB In Preparing Rollout Of Digital Currency

>First it was the Fed, then the ECB, and now the BOJ: the world's central banks are quietly preparing to unleash digital currencies on an unsuspecting population in one final last-ditch attempt to spark inflation and do away with the current monetary orthodoxy which has failed to push living conditions for the masses higher (but most importantly, has failed to inflate away a growing mountain of insurmountable global debt).

>On Friday, the Bank of Japan joined the Fed and ECB when it said it would begin experimenting on how to operate its own digital currency, rather than confining itself to conceptual research as it has to date.

>Naturally, to avoid sparking a panic that paper money is on its way out - and thus prompt the population to hoard it - the BOJ said that CBDCs "will complement, not replace, cash and focus on making payment and settlement systems more convenient." However, how exactly it is "more convenient" for the central bank to be able to remotely extinguish any amount of money in one's digital wallet without notice, remains a mystery.

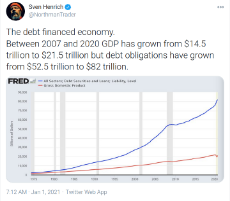

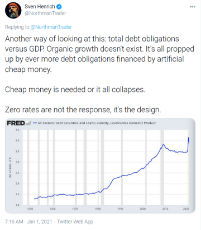

>Finally, why are central banks using blockchain as the backbone for all digital currency efforts? It has nothing to do with their fascination with bitcoin, or their fear that cryptocurrencies can become dominant (although there certainly is an element of that). The real reason is that blockchain allows every single discrete currency unit, whether it is the digital dollar, digital euro, digital yen or digital yuan, to be tracked from its digital inception, through every single transaction, and to which wallet it can be found in at any given moment. In short, blockchain-based digital currencies will allow central banks to have a real-time map of absolutely every monetary unit in circulation, and every single economic transaction, something they can't do with trillions in anonymous paper money still sloshing around

https://www.zerohedge.com/markets/circle-complete-boj-joins-fed-and-ecb-preparing-rollout-digital-currency

>First it was the Fed, then the ECB, and now the BOJ: the world's central banks are quietly preparing to unleash digital currencies on an unsuspecting population in one final last-ditch attempt to spark inflation and do away with the current monetary orthodoxy which has failed to push living conditions for the masses higher (but most importantly, has failed to inflate away a growing mountain of insurmountable global debt).

>On Friday, the Bank of Japan joined the Fed and ECB when it said it would begin experimenting on how to operate its own digital currency, rather than confining itself to conceptual research as it has to date.