https://southfront.org/behind-the-scene/

A study in landscape design for exotic places on Earth.

Let’s try to bring some context to the never ending discussion of offshores.

The amount of leaks concerning offshores may very well surpass the amount of legal information. More than 13 million of documents have fallen into the public’s hands, and the media try their best to find some recognizable names out of vast expanses of text, trying to match them with known information.

It’s time to dot the i’s and cross the t’s by laying some fundamental truths out.

Let’s start with the big question.

Who keeps the money in the offshores? Doesn’t matter whether the offshores are British, American, Asian or Middle Eastern.

If we want to keep it simple then the answer is everyone who has money. One way or the other they keep them in offshores.

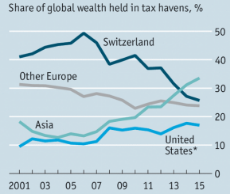

Since the 1920s, Switzerland has existed in its own international banking dimension. The European cream of the crop all kept their money there.

In the early 80s, 16 territories around the world join Switzerland, from Bahamas to Hong-kong.

Since then, the amount of companies circumventing the state tax laws has been increasing 200-300% per year.

In 2016, an unprecedented study was conducted thanks to the efforts of Bank for International Settlements. This study showed that the amount of money kept in offshores equals to 10% of the world’s GDP. 10% was the lowest estimate.

For example, Russia had offshored a sum equivalent to 50% of its GDP, Venezuela, Saudi Arabia and United Arab Emirates did so with 60-70% of their GDP. The UK and the EU had offshored approximately 15% of its GDP (the actual number is much higher).

0.01% of the richest families of the UK, France and Spain have offshored from 30 to 40% of their respective GDPs.

In Russia, this number reaches 85%. In China, 95%.

The US’s is estimated to be 60-70%, as Delaware does not disclose its information to international organizations.

So, if you take a look at all of the offshore data, and not only at random snippets, you’ll see the very best houses of our small planet there. The worst houses will be there too.

If we apply these numbers to this map, provided by the Tax Justice Network, this is what we get:

Overall there are $21 trillion in offshores, $9.8 trillion of which are assigned to people with wealth over $30 million.

That, strictly speaking, does not seem fair.

Overall the world’s cash tends to pass from the EU and the Americas to Southeast Asia, which can be observed here (figure 2)

I'd also like to mention a thread another that specifically detailed the Netherlands tax haven, however I believe it has been deleted long since deleted. I can recreate it if requested in this thread.

/mlpol/ - My Little Politics

Archived thread

>>87652

It is truly a shit ton of money that moves into "hiding".

I think the next move people take (when they see the writing on the wall) is moving it into countries that don't extradite or comply with "western nations". There is a couple of people guilty of large scale embezzlement that have moved to countries like Pakistan, Ghana and other african, asian and gulf states. There they live lives in luxury without having to worry about the police or having to pay back the money they embezzled.

It is truly a shit ton of money that moves into "hiding".

I think the next move people take (when they see the writing on the wall) is moving it into countries that don't extradite or comply with "western nations". There is a couple of people guilty of large scale embezzlement that have moved to countries like Pakistan, Ghana and other african, asian and gulf states. There they live lives in luxury without having to worry about the police or having to pay back the money they embezzled.

Offshore Banking in a nutshell

[YouTube] The Simpsons - Bart The Fink 0715 - Cayman Islands

its physical theft of taxation money. AS far as I am concerned it should be outlawed and replaced with a law that forces companies and wealthy privateers to subject all their income to their nation state for taxes. What are all these bloated sacks of money going to do with all their wealth? In case of a banking crisis or a war in the offshore country this stuff will go down the drawin all the same.

Never understood why the Führer never annexed Switzerland back in the day. That would have drawing a lot of the money swamp in Europe we have today.

>>87670

>Anschluss Switzerland

It would have been a long and bloody war against their German brothers, in the end Switzerland allowed nsdap access to their rail lines anyway so it wasn’t a strategic problem. Most kike banking took place and still takes place in the city of London, which like DC and th Vatican is a nation within a nation and a headwater of international jewry.

>Anschluss Switzerland

It would have been a long and bloody war against their German brothers, in the end Switzerland allowed nsdap access to their rail lines anyway so it wasn’t a strategic problem. Most kike banking took place and still takes place in the city of London, which like DC and th Vatican is a nation within a nation and a headwater of international jewry.

>>87670

This is why. The guerilla warfare in Switzerland would have made the resistance in France and Eastern Europe look like welcoming parties. Not to mention that every invasion of another neutral nation turns world opinion against you a bit more.

Besides, you're buying into the Marxist mindset if you think that private money exists only to be taxed and used by the state. You'd actually rather your wealth be taken and used to prop up Israel and feed the rapefugees?

This is why. The guerilla warfare in Switzerland would have made the resistance in France and Eastern Europe look like welcoming parties. Not to mention that every invasion of another neutral nation turns world opinion against you a bit more.

Besides, you're buying into the Marxist mindset if you think that private money exists only to be taxed and used by the state. You'd actually rather your wealth be taken and used to prop up Israel and feed the rapefugees?

>>87687

How many regular private citizens have access to offshore Bermuda or Netherlands banks accounts? These are your biggest companies like Activision.

How many regular private citizens have access to offshore Bermuda or Netherlands banks accounts? These are your biggest companies like Activision.

>>87689

And these big companies have such bank accounts because the corporate tax rates as so high as to drive them away. Also, such companies have access to lawyers that would give them an edge anyway. Introducing special legislation to combat this would reduce the rights of every citizen. You can't win by inciting class conflict, and the more you do so the more you become like the commies we all hate.

I respectfully disagree. If you want the wealthy to bring the wealth back to their countries stop treating them like loot to be plundered. Lower taxes like Trump wants to do.

And these big companies have such bank accounts because the corporate tax rates as so high as to drive them away. Also, such companies have access to lawyers that would give them an edge anyway. Introducing special legislation to combat this would reduce the rights of every citizen. You can't win by inciting class conflict, and the more you do so the more you become like the commies we all hate.

I respectfully disagree. If you want the wealthy to bring the wealth back to their countries stop treating them like loot to be plundered. Lower taxes like Trump wants to do.

>>87691

First, lowering corporate tax rates doesn't bring anymore job creation. You can look at this report here:

https://www.foreffectivegov.org/sites/default/files/budget/corp-tax-rate-debate.pdf

>22 of the 30 corporations that paid the highest tax rates (30 percent or more) on their reported profits created almost 200,000 jobs between 2008 and 2012. Only eight of the 30 firms paying high tax rates reported reducing the number of employees between 2008 and 2012.

And, there's other points. Also, all tax reform is revenue neutral, it's not an average rate that's being applied but sparse. Some see a higher rate, some don't.

Another thing, George Soros evades taxes all day. He owes almost 7 billion dollars. Those are 7 billion dollars being used to fuck over your ideology from both ends of the spectrum. My point here is that there's some shitty people evading these taxes like in Saudi Arabia. You should take a look back at the numbers again posted:

>Overall there are $21 trillion in offshores, $9.8 trillion of which are assigned to people with wealth over $30 million.

>0.01% of the richest families of the UK, France and Spain have offshored from 30 to 40% of their respective GDPs.

I don't see how ending deferrals "would reduce the rights of every citizen" or how this would incite class conflict. In fact, I think letting tax evasion run rampant creates more class conflict because it leads to more resentment, rallying your figures like Bernie Sanders for example. I mean, looking at these figures, do I feel pissed. And, since this is a point about emotion, that's valid.

First, lowering corporate tax rates doesn't bring anymore job creation. You can look at this report here:

https://www.foreffectivegov.org/sites/default/files/budget/corp-tax-rate-debate.pdf

>22 of the 30 corporations that paid the highest tax rates (30 percent or more) on their reported profits created almost 200,000 jobs between 2008 and 2012. Only eight of the 30 firms paying high tax rates reported reducing the number of employees between 2008 and 2012.

And, there's other points. Also, all tax reform is revenue neutral, it's not an average rate that's being applied but sparse. Some see a higher rate, some don't.

Another thing, George Soros evades taxes all day. He owes almost 7 billion dollars. Those are 7 billion dollars being used to fuck over your ideology from both ends of the spectrum. My point here is that there's some shitty people evading these taxes like in Saudi Arabia. You should take a look back at the numbers again posted:

>Overall there are $21 trillion in offshores, $9.8 trillion of which are assigned to people with wealth over $30 million.

>0.01% of the richest families of the UK, France and Spain have offshored from 30 to 40% of their respective GDPs.

I don't see how ending deferrals "would reduce the rights of every citizen" or how this would incite class conflict. In fact, I think letting tax evasion run rampant creates more class conflict because it leads to more resentment, rallying your figures like Bernie Sanders for example. I mean, looking at these figures, do I feel pissed. And, since this is a point about emotion, that's valid.

www.zerohedge.com/news/2015-04-30/billionaire-hypocrisy-soros-may-owe-7-billion-taxes

https://www.forbes.com/sites/kellyphillipserb/2015/05/01/geoge-soros-may-owe-billions-in-taxes/

https://www.forbes.com/sites/kellyphillipserb/2015/05/01/geoge-soros-may-owe-billions-in-taxes/

8 replies | 4 files | 1 UUIDs | Archived

Ex: Type :littlepip: to add Littlepip

Ex: Type :littlepip: to add Littlepip  Ex: Type :eqg-rarity: to add EqG Rarity

Ex: Type :eqg-rarity: to add EqG Rarity